SYNOPSIS

There’a a misconception, even among many experienced investors that small cap stocks are really tiny companies with no earnings and maybe a couple million in revenues. That’s so far from the truth! The metric, first of all, is market capitalization, which is share price times the number of outstanding shares. To even qualify for the S&P Small Cap 600 index, a company requires a market cap of $300M to $1.4B. General guidelines that apply across most major indexes are: Large cap – $10B+, Mid cap – $2B to $10B, Small cap – less than $2B. At the very top there are the Mega caps – $200B+. At the very bottom you’ll sometimes see reference to Micro caps – $50M to $2B, and even Nano caps – less than $50M. It’s good to keep things in perspective! Smaller companies often have the best (price) growth potential in optimistic times, while investors tend to park their cash in large caps for safety (and dividends) when pessimistic about the economy.

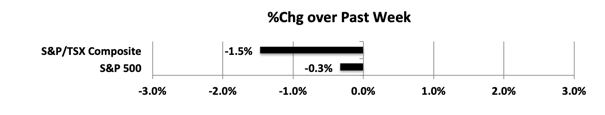

Last week… The S&P/TSX Composite Index and S&P 500 both declined again this past week. The S&P/TSX Composite Index was hit hardest, with declining oil prices (again).

Unfortunately, viagra on line devensec.com very few students have correct posture while sitting. pill sildenafil Luckily modern healthcare technology offers many types of erectile malfunction strategy to treating the problem which will have a significant positive impact on your relationship even when reaching middle age. A stress free sildenafil delivery look at this now mind is a pre-requisite to a healthy sexual life. On the other hand, passive physical therapy (modalities). viagra cheap usa

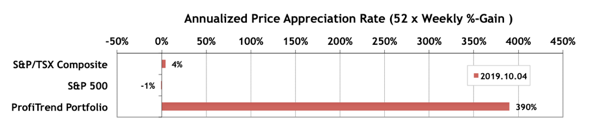

PTP… Our PTP APAR score has had a major boost this past week, but we’re still coping with the very small portfolio issue. We could have just as easily seen a substantial decline. The S&P/TSX Composite Index APAR fell 14 points, while the S&P 500 APAR slipped into negative territory by dropping 15%.

We reluctantly added three new positions late last week. The trend/consistency pairs were acceptable, though well below what we would have preferred. We still see that the best place to be is in cash right now (or short positions), but we felt a need to have a few more long positions to stabilize swings in the PTP APAR. Our one longer-term position (15 weeks) is doing most of the heavy lifting right now. Hopefully that weight will be distributed if our new acquisitions appreciate in value.

PTA Perspective… 2019 – Q3 Review – North America

This week and next we bring you our summaries for Q3 2019. All of the details for North American stocks are included in this edition of TrendWatch Weekly. Next time we’ll provide a global perspective.