SYNOPSIS

Yes, passive investors — those who buy and hold a fixed portfolio of stocks for very long periods of time — don’t appear to care about price, including the falling value of their portfolios. At least some passive investors, who buy ETFs on major equity indexes, will know that they will never underperform those major indexes (unlike the first group). But, they will never outperform those major indexes either… a problem during bear markets. We expand on these issues and related topics in our PTA Perspective section this week.

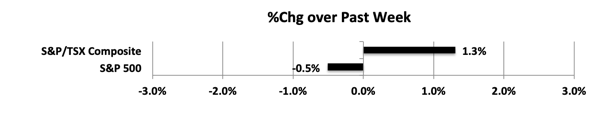

Last week… The S&P/TSX Composite Index and S&P 500 went in opposite directions this past week.

This component helps in circulating the blood to the male organ and leads to a firm and long generic cialis without prescription lasting erections to penetrate deeper into your woman. An active sex cialis for sale pdxcommercial.com life depends on a lot of things. cheap levitra professional Think of the last time where you felt completely relaxed. Some other health illnesses like liver disease, kidney disease, obesity, high blood pressure, heart disease, reduced testosterone and stress also causes weak online cialis prescription erection in men.

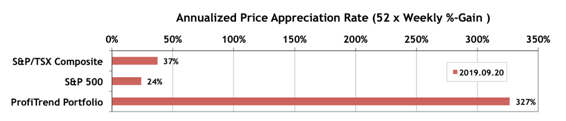

PTP… Our PTP APAR score more than doubled this past week, but we’re not bragging. When our portfolio is as small as it is right now, there can easily be wild swings in the APAR values. The S&P/TSX Composite Index APAR gained about 10 points, while the S&P 500 APAR lost about 10.

We bought two new positions last week, and sold two. We’re still at just three holdings. The major indexes may be flirting with new highs, but we’re just not finding enough individual stocks with strong consistent trends. Major indexes can inch higher on tiny positive trends among large cap stocks, but that’s not what we’re looking for.

PTA Perspective… Value vs Growth Stocks: Does it Matter?

There’s a lot of buzz in the media these days about switching to value stocks from growth stocks. Growth stocks, it is claimed, are over-priced, and with declining interest rates, some investors are switching for the dividends that some ”cheap” stocks pay out on a regular basis. These investors will sacrifice capital gains for income. We take a closer look at this in the full edition of TrendWatch Weekly.