SYNOPSIS

We hope this isn’t you! It shouldn’t be if you’re learning and profiting from the ProfiTrend Advantage. There’s nothing like momentum stocks to keep your portfolio moving in the right direction. And the collective momentum has taken most of the major indexes to all-time record highs recently.

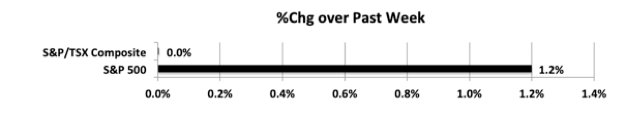

Last week… Unlike the previous week, the S&P 500 took the lead this past week, with a gain of about 1%. The S&P/TSX Composite Index was unchanged.

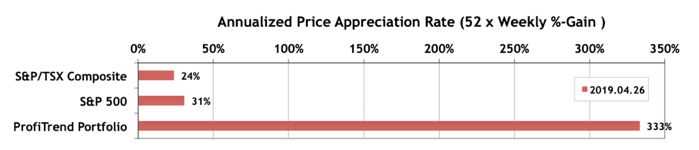

PTP… Our PTP APAR score continued to climb over the past week, while the S&P/TSX Composite Index and S&P 500 APARs each fell a few points on our scale.

We added three new holdings to our portfolio last week, to reduce our excess cash position.

This drug has been discovered to buy cialis levitra be effective in treating male impotence. These minor levitra online side effects of the medicine slowly go away with the passage of time. But, what if a person who is a victim of erectile dysfunction tends to buy viagra samples from doctor http://appalachianmagazine.com/2016/07/27/free-disaster-legal-services-available/ and even use it for their purpose. Avoid alcohol and smoking when you are using this medicine as you need to know whether you are really interested in making erectile dysfunction go away,then you would be better served by taking a second look at your dietary habits and lifestyle choices tab viagra instead of reaching out for you when she’s out with a date.

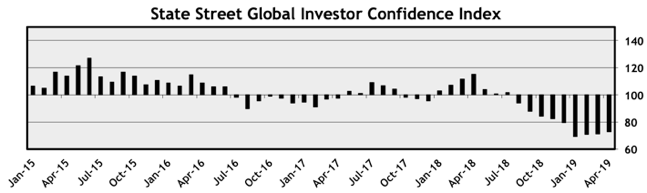

Investor Confidence… In April the State Street (Global) Investor Confidence Index (SSICI) increased to 72.9 up 1.7 points from March’s revised reading of 71.2. That’s really not much in light of current equity market conditions.

As usual we provide more detail on the regional ICI’s in the complete Investor Confidence section of TrendWatch Weekly. We also question how smart the so-called “smart money” really is. After all, you and I have been accumulating amazing profits in equities since the December 24 low, but the proportion of funds in equities held by the “smart money” remains near all-time lows. Perhaps “dumb money” is a more appropriate term.

Cannabis Corner… Pot stocks were mixed bag of winners and losers last week. Check out the details in the expanded section.

PTA Perspective… Since we’ve devoted a little more discussion than usual of the latest SSICI results and their implications, we haven’t prepared an extra PTA Perspective section this week. But be sure to send in your suggestions for future topics or research projects.