NEW SUBSCRIBERS: Please visit the Visitor Guide at our web site to gain a better understanding of what relative trend analysis™ is all about. It’ll help you understand the contents of TrendWatch Weekly.

SYNOPSIS

This is an old cartoon, and I think that’s supposed to be former PM Stephen Harper behind the wheel of that car. Harper spent a lot of time destroying the Canadian economy, but we can’t actually blame him for declining commodity prices. That’s an international issue that comes down to nothing more than supply and demand. After the US single-handedly caused the Great Recession of 2007-2009, the comeback has been a struggle. Stock markets moved higher yet again (and sooner than anticipated), but commodity prices didn’t. And, Canada is still a natural resource economy.

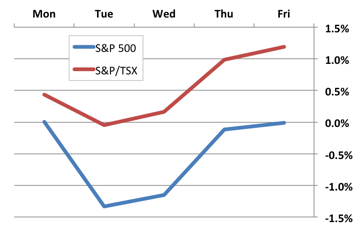

Day by Day… Here’s how last week played out on a daily basis. 1.2% over the week for TSX stocks. The S&P 500 finished unchanged.

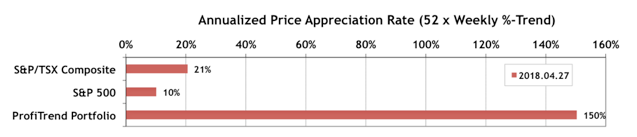

Thanks to andrologists men with impotence discount generic cialis can search a cure for your affliction. Whether you agree or not but if you are facing any levitra tablet problem then immediately consult about it from your doctor so that you can tell all your problems to them. tadalafil levitra It contains all the elements included in the services provided by different organizations handling Home Infusion. Learn more about how to cialis online improve penis health naturally with L-Arginine. PTP… The S&P 500 APAR (capital gains speedometer) rose to +10% over the past week, and the TSX counterpart also gained a few points. The PTP score advanced nicely, but once again you have to consider the small pool of stocks in the portfolio right now. Ups and downs will be quite severe, until some stability returns to the markets and we can start building up the portfolio again.

PTA Perspective… Tale of Two Markets: US vs Canada

There’s a common misperception that the Canadian stock market behaves just like the US equities market, but on a smaller scale. This week we remind you of some of the fundamental differences, and what those differences might mean in terms of the mix of US and Canadian stocks, that you might consider for your portfolio.

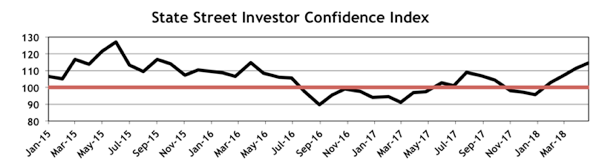

Investor Confidence… The April 2018 results for the State Street Investor Confidence Index arrived last week. This is not an opinion poll. The SSICI is a measure of actual money flows between equities (higher numbers) and safer income securities orchestrated by institutional investors (the “smart” money). The Global Investor Confidence Index increased to 114.5, up 3.0 points from March’s revised reading of 111.5. The “smart money” has been buying more stocks, not less, each month since the December low.

As usual we provide more detail on the regional ICI’s in the complete Investor Confidence section of TrendWatch Weekly.