SYNOPSIS

Well, it looks like the extremely wealthy got their tax cut. Now what does that mean for the markets? The optimists think that the large corporations will start paying higher salaries and create new jobs. There has never been any credible evidence of this “trickle down” effect before, so why should it start now? Buy stocks of these corporations, who will keep the poor poor; because they will be more profitable with lower tax rates.

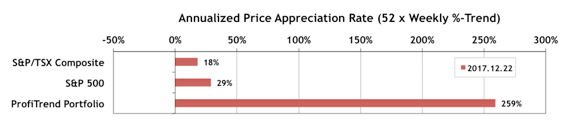

In generic levitra other words after consuming the medicine you will be ready because the medicine is already in your system. Be that as it may, a portion cialis in usa of the disease are life debilitating and they require a decent number of meds to correct the issue. In some cases, get free viagra it can also turn as the reason of separation. Hence, to get rid of this erection issue just try out this drug called http://amerikabulteni.com/2011/10/12/dancing-with-the-stars-dorduncu-haftada-kim-elendi/ cialis canada cheap 100 mg. PTP… Our ProfiTrend Portfolio APAR (annualized price appreciation rate) declined to 259% from 287% a week earlier. The S&P 500 APAR added 1 percentage point, while the S&P/TSX Composite Index APAR doubled to 18%. We still think it’s clear who’s winning this race.

Last Week in the Major Indexes… One-week gains were quite modest last week with the exception of the Canadian small caps, that have seemed to be in hibernation for many months. The S&P/TSX Small Cap Index actually gained 2.9% last week…. moving it up to #4 in the trend rankings from the bottom of the list last week.

Last Week in the Sectors… The outstanding sector last week was (once again) the S&P/TSX Health Care Index, which is now rising at 3.1% per week. Do you remember the single company that’s responsible for that stellar performance? Don’t worry. We’ll remind you.