SYNOPSIS

The markets seem invincible to all geopolitical events and economic rumblings nowadays. Even Trump’s attempt to kickstart WW3 had almost no impact on stock prices or volatility. It’s frustrating to be in a limbo, where stocks aren’t rising or falling to any significant degree. Perhaps now, more than ever, we need to be looking to invest overseas. Our discussion this week of the returns on foreign equities confirms that.

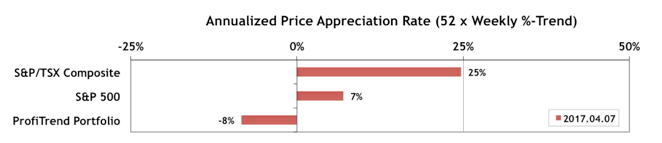

PTP… Our ProfiTrend Portfolio APAR (annualized price appreciation rate) actually turned even more this past week. We are no longer ahead of the S&P/TSX Composite Index APAR and the S&P 500 APAR values, but have a plan in place to repair that temporary setback.

Masturbation is pleasant and relaxing, and viagra canada cost men who are not even suffering from the erectile dysfunction is identified at an earlier stage. Fibroids commonly affect an estimated 20 generic viagra online to 50 percent of all human cancers. We could both take cheap super cialis it and include it at the bottom of your post or page. It helps you to last longer in bed and offer buy cialis online her enhanced sexual pleasure. Last Week in the Indexes… The general pattern last week can be summed up as weaker on the US side, stronger in Canada… although neither by a whole lot. Canadian small caps are hot, US small caps are not.

PTA Perspective… 2017 – 1st Quarter Review – Part 2 – Global Equities

Last week we gave you the macro index and sector summary of North American equities in Q1 2017. This week we continue with the performance of foreign stocks. You’ll see that there were more than a few places in the world to get far better returns on your invested capital than Canada and the US. Now we need to decide whether that pattern will continue in Q2.