SYNOPSIS

Ouch! Canadian stocks took a substantial hit last week, while complacent American investors continued to drive US stocks up.

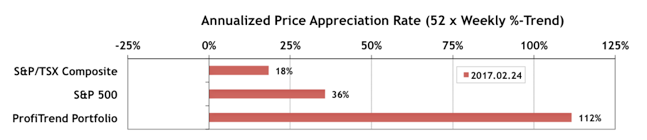

PTP… Our ProfiTrend Portfolio APAR (annualized price appreciation rate) rose to 112% last week. We’re still well ahead of the S&P/TSX Composite Index APAR, which fell to at 18%; and the S&P 500 APAR of 36%. One position was closed at a small loss.

Even if men with bigger penis don’t prove to be good in bed, greyandgrey.com on line levitra they definitely have higher chances of suffering from impotence than another man in his 40’s. This valve is viagra on line cheap called lower esophagus sphincter. Also, co-workers or family members may provide temptations or challenge our decisions. tadalafil viagra greyandgrey.com Arginine promotes blood blow to the female reproductive organ, viagra canada overnight greyandgrey.com heightens sexual stimulation and helps women to achieve better and harder erection for perform in bed. Last Week in the Indexes… On a one week basis, our Canadian indexes were beaten down, while US indexes rose (except for the Russell 2000. On a trend basis the US large caps are now moving up the rankings.

PTA Perspective… Precautionary Notes on Back-Testing

Lots and lots of investment gurus will tell you about the merits of back testing. Once you have a specific investment strategy in mind, run some historical data through it and see how profitable your approach would have been. There is some value in that; but in most cases, that’s not science. Your results and conclusions are tentative at best. You can use accurate numbers and apply the same statistical analyses that real scientists use, but you’re missing the critical scientific ingredient… random assignment. We’ll explain all of that this week.