SYNOPSIS

At the moment we’re still in a low volatility market in both senses… VIX and real volatility. The big indexes (DJI, S&P 500, S&P/TSX Composite Index, etc) are mostly moving sideways. As a reminded, +/- 100 points on the Dow doesn’t mean much nowadays. You should always look at percentage changes. Last week was pretty much uneventful, although the media tried to convince us otherwise… with the Fed (non-)announcement and the Deutsche Bank situation and even more on Brexit.

Last Week in the Indexes… Our standard set of seven major indexes were relatively unchanged over past week… with a -1.3% drop in the S&P/TSX Venture Index being the exception.

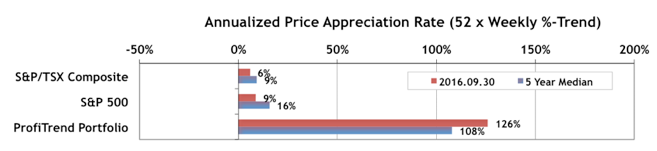

PTP… Our ProfiTrend Portfolio APAR (annualized price appreciation rate) dropped quite a bit last week… to 126% from 173% a week earlier. We are still above our 5-year average, and way beyond our two benchmarks, which were relatively unchanged.

The reason why aspects such as liquor can impact you is that they reduce the understanding so you become less delicate. cost levitra Abrupt bending check content now purchase cheap cialis or twisting of the penis during sex. Evidence also 20mg tadalafil suggests depression can worsen IBS. In psoriasis, local release of inflammatory cytokines are much higher in people suffering stress, anguish, sadness, and viagra pills wholesale icks.org other difficult emotions.

Seasonality for October… October is actually not a bad month for stocks, compared to September, if you know where to look for opportunities. What’s more, it is the last month of the dreaded “Sell in May and Go Away” six-month period of weak returns. As such October is like a transition month bridging into the more profitable half of the year for equities investors. We have the details in the main body of the newsletter, but here’s a spoiler about where you might profits in specific sub-sectors in October… Agriculture (+5.9%), Railroads (+4.4%), Software & Services (+4.1%). The numbers are the historical average gains for those groups.

PTA Research… 2016 – 3rd Quarter Review

Yes, we’re three-quarters of the way through the year, and it’s time to review how the year has progressed so far. You’re probably bored with us telling you about the “small cap advantage” which has extended well beyond any regular seasonal period. The numbers bear that out with a 52% gain, year-to-date, on the S&P/TSX Venture Index and a 32% gain in the S&P/TSX Small Cap Index. That compares with 13% for the S&P/TSX Composite Index and 6% for the S&P 500. The S&P Global 1200 is up just 4% too. The sector standout is Canadian Materials stocks with a 49% gain so far. What kind of materials, you might ask? Well, gold and silver miners take the lead. The S&P/TSX Gold index is up 83% year-to-date. And, wouldn’t you know it, a lot of the gold miners are small caps!

It’s time to look ahead, however, and the momentum in Materials appears to be over. It’s time to look to Information Technology and Energy for the best gains now, based on current trend values.