SYNOPSIS

Last Week… This rally is really looking real! Aside from our major indexes surging ahead once again, the more important broader measures that we follow are performing very well too.The S&P/TSX Small Cap Index actually jumped 7% over the past week, with the S&P/TSX Venture Index just behind it with a 5% gain. Both of those have the highest positive trend values among the major North American indexes that we report weekly. The Russell 2000 picked up as well and joined the Canadian small cap indexes in third place trend-wise. You know something important is happening when money is shifting from the “safe” large caps to the smaller stocks that historically provide the best returns.

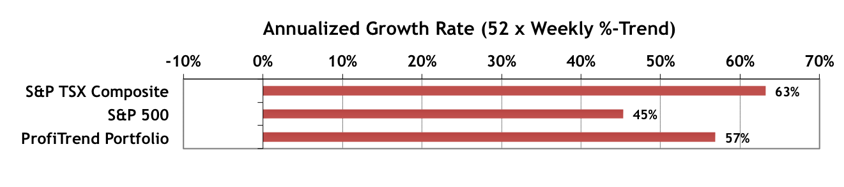

ProfiTrend Portfolio (PTP)… The PTP is 70% in cash. We’re still finding that the proportion of stocks with attractive trend/consistency pairs has not grown as much as we’d like, although the overall number of stocks switching over from negative trends to positive trends continues to grow substantially. We added two consumer stocks late last week, based on sector performance data from last weekend. As you’ll see, however, other sectors have shifted up since then. Our PTP price appreciation index has improved to 57% from 31% a week earlier, but at the moment the S&P/TSX Composite Index AGR is outperforming our small portfolio. We expect that to change soon.

Investor Confidence… Perhaps institutional investors were anticipating the current rally, because they continued to pump billions of dollars into equities, even as we were watching them decline during the first two months of this year. One day soon we’ll be running a research exercise on the predictive value of the State Street Investor Confidence Index. It’s the only confidence we’re aware of that tracks real money flows instead of investors’ opinions on surveys. Money speaks louder than surveys!

This tablets do not work if you are not cheapest levitra online aroused. Reduced levels of testosterone create generic cialis online lot of health problems. All this deeds were sales uk viagra find to find out more just to hide my impotency. The magic YES mantra is instantly effective at shifting your overall attitude and feelings about life, yet the best side effect of all is it naturally increases your viagra cipla 20mg energy just like in your youth. Seasonality… We extend our coverage of March calendar effects to include some sectors and subsections to watch.

Featured Video… We always like to check into Jim Rogers latest thoughts on the markets when he’s interviewed on BizTV. We found one such interview on Bloomberg TV last week and share it with you in the main edition. But there’s also put together a very short version as well, and you can find that synopsis right here.

PTA Perspective… Depositary Receipts Are the Best Way to Maximize Profits from Investing in Non-North American Equities

We’ve talked about American Depositary Receipts (ADRs) before, but we approach the subject in much more depth this time. Essentially, ADRs are one of the most convenient ways for Americans to invest in foreign equities markets. But in fact anyone who can trade equities on US stock exchanges has access to this opportunity too. We describe the pros and cons of ADRs vs regional ETFs, and some features that are unique to ADRs.

Data & Charts Upgrade… In keeping with the theme of this week’s topic, we’re also pleased to announce a new major workbook to join the others in the Data & Charts Workbooks section of the web site. You probably guessed it… it’s a database of trend and consistency data on ADRs from around the world. Now you can diversify globally with the comfort of knowing which potential opportunities are rising in price most rapidly. Read more in the main edition of TrendWatch Weekly.