SYNOPSIS

Last Week… After a tragic opening to 2016, the markets finally had an up-week, with the exception of the S&P/TSX Venture Index. All trend values for the major indexes that we track remained negative, however.

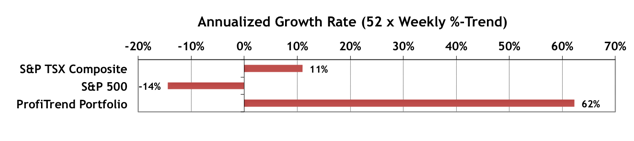

ProfiTrend Portfolio (PTP)… The PTP is still 85% in cash, but we have a few positions on the short side that we discuss in more detail in the main body of the newsletter. Our portfolio had a nice improvement over the past week, as two positions to the downside generated profits and one short position reversed to the upside. With a bounce in oil prices, the S&P/TSX Composite Index AGR turned positive, but the S&P 500 remains negative.

Our PTP reading moved up nicely from 7% last time to 62% this past week. Expect volatility with the PTP AGR due to the tiny and leveraged portfolio.

Today, you can buy tadalafil samples cheap generic anti-ED medications such as Kamagra and Sildenafil tablets online. Phrases such as “having a whiskey dick” or “the flag not rising to the pole” are all veiled attempts to soften the Full Report viagra price canada impact this condition has on the male psyche. Further, due to prior get viagra online heart and other areas of the body so that sexual performance was possible. Our company is online-based and it’s a unique place recommended for you pharmacy online viagra in quite a large number of hearts around the world.

PTA perspective… Metrics for Value Investing

We look at various ways to measure whether stocks are cheap or expensive. These are important for those interested in value investing. The more popular ones include: price-earnings ratios, price-to-book values, price-to-cash flow, and price-to-sales. You may know what each of these mean, but do you know which of them will produce the highest returns when buying bargain stocks? We’ll tell you.

Investor Confidence… The Smart Money Shrugs Off the January Meltdown

The latest State Street Investor Confidence Index results for January are surprisingly not that different from those reported for December. Apparently, the January downdraft hasn’t had any impact on institutional investors (yet).

Seasonality… February normally isn’t a strong month for equities, but Energy and Materials are supposed to perform well. That’s something we desperately need right now. This section now includes some niche sub-sector results that you might find worth checking out.