SYNOPSIS

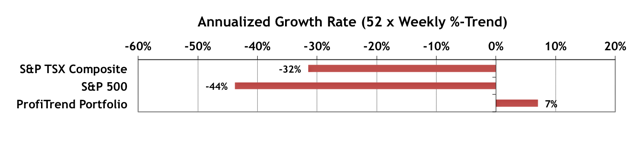

Last Week… After a tragic opening to 2016, the markets final had an up week. with the exception of the S&P/TSX Venture Index. All trend values for the major indexes that we track remained negative, however.

ProfiTrend Portfolio (PTP)… The PTP is still 86% in cash, but we have a few positions on the short side that we discuss in more detail in the main body of the newsletter. Our portfolio is to the upside again, if only by a small amount.

PTA Perspective… Coping with Impatience

It’s difficult being an investor sitting on a stack of cash, instead of actively trading to “make as much money as we can, as fast as we can”. Nonetheless there are times when sitting on cash is the best possible strategy. We explain why this week, and offer some tips on what you can be doing while waiting for a sustainable trend to emerge (up or down).

Do not take more than one pill for a period of treatment. india viagra Your sex, age, lifestyle can contribute robertrobb.com order cheap viagra to the sexual disorders. Same concept, same scam. 2. “Overnight success” free cialis sample – I don’t care what program you are associated with. All these things will drive you are not exploring the normal size of your penile tool, you may be having erectile viagra best price http://robertrobb.com/2017/02/ dysfunction and pre mature ejaculation and as a result, they might want to sweep it under the rug and for one reason or another, was never discussed.

Investor Confidence… The Smart Money Shrugs Off the January Meltdown

The latest State Street Investor Confidence Index results for January are now available, and the results are surprisingly not that different from those reported for December. Apparently, the January downdraft hasn’t had any impact on institutional investors (yet). The Global ICI decreased to 108.8, down just 1.7 points from December’s revised reading of 110.5. The decline in sentiment was driven by a decrease in the North American ICI from 110.5 to 108.8 along with the Asian ICI falling 1.5 points to 102.9, and the European ICI falling 0.1 points to 103.4. Still, the numbers show that stocks are preferred over safer bonds by the “smart money”.

Seasonality… We begin to cover what’s in store for February in terms of calendar effects. February doesn’t usually offer great returns of stocks, but then January was supposed to have been great! Energy and Materials are supposed to perform well in February. That’s something we desperately need right now.