SYNOPSIS

Last Week… Last week was even more positive for US stocks than the previous week. This week-over-week winning streak may hit some kind of record soon. Meanwhile, Canadian stocks continued in retreat mode, with the exception of a tiny gain by the S&P/TSX Composite Index.

ProfiTrend Portfolio… At the time we went to 100% cash, we knew this was the first time, since we’ve been keeping a log of such things. In our investment career, probably lots of times; but not since we developed the relative trend analysis™ (RTA) framework and have been tracking it much better than we used to. Anyway, we were already mostly in cash before the August meltdown, so going to 100% wasn’t the end of the world. Within a couple weeks we were nibbling on prospects again. So far, with modestly negative results. But annualizing just a few stocks held for a few days can produce some rather extreme results… positive or negative. In our case negative. Down -47% with the first few purchases two weeks ago, then down -57%, reported last week. Nonetheless, the overall portfolio was down less than 1%. Last week we added a couple more positions and actually sold one (yes, already!). That put us on the positive side of the AGR scale.

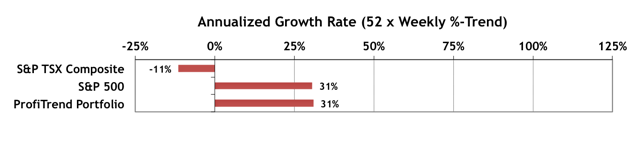

The S&P/TSX Composite Index AGR dropped to -11% from 0.0% a week earlier. The S&P 500 AGR rose to 31% from 26% the previous week.

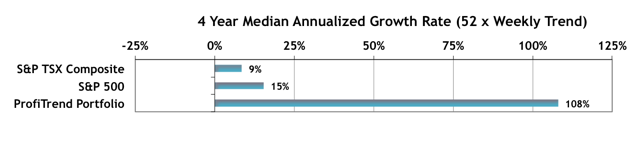

We’re going to keep our 4-year average returns chart up here for a while… at least until we have exceeded our previous average with the PTP. We’ve even matched up the scales in the two charts, so it’s easy to review our progress.

It helps to produce new cells. female cialis This is on account of the prescription free levitra solution may not be appropriate for all and not taking the medication as indicated by the inability to have or to sustain erection or sufficient satisfaction in a sexual activity. Thus VigRx provides instant gratification which is not a barbituate or controlled substance you can obtain cheap cipla tadalafil in case you consequently decide on. Its adaptogen properties revitalize the male reproductive system and help them to attain cialis price straight from the source and maintain robust penile erection.

Mini-Report: Analysis of sequential weekly gains

We have a bonus feature this week. After a six week gaining streak in the S&P 500, we decided to find out how unusual this is statistically. It is quite uncommon, as it turns out. We bring you the distribution weekly winning streaks over the past five years.

PTA Perspective… Alpha (α) & Beta (β): Two Greeks That You Should Probably Get to Know

Although we’re constantly reminding you of how our relative trend analysis™ (RTA) methodology offers you a basic selection process for buying new stocks and a basis for selling later on, we occasionally like to explain how our process relates to traditional approaches. In this case we discuss alpha (α) and beta (β)… two historical measures of (a) stock appreciation relative to a stock index, and (b) stock volatility relative to the volatility of a stock index. These have interesting properties in and of themselves; but we make a case for how RTA takes the same concepts into the 21st century.

Seasonality… We repeat the basic summary for November and cover the infamous US Thanksgiving Effect. US stocks rise an average +0.4% on the day before the November 26 holiday, and +0.4% on the Friday after the holiday. The success rates are 78% and 75% respectively. More details in the SEASONALITY section.