SYNOPSIS

Nasdaq performed well again on a one-week basis. Canadian small caps are also near the top on a trend basis. The S&P/TSX brings up the rear among our major indexes with an almost non-existent trend of +0.1%.

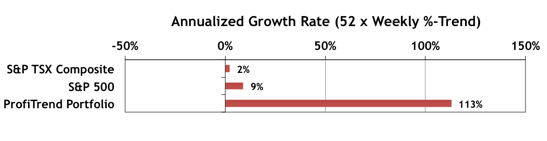

ProfiTrend Portfolio… The annualized growth rate for the ProfiTrend Portfolio is now at +113%, up from 100% last time. Still well ahead of the benchmark indexes as usual.

Smart Money… JUST OUT! The State Street Investor Confidence Index results for May are included. The “smart money” continues to pump up stock purchases. The Global ICI increased to 120.8, up 7.0 points from April’s revised reading of 113.8. Confidence among North American investors increased with the North American ICI rising 8.0 points to 129.4, up from April’s revised reading of 121.4. Meanwhile, the Asia ICI rose by 7.4 points to 98.6. However, the European ICI fell 5.5 points to 103.8.

Health http://djpaulkom.tv/dj-pauls-safe-way-to-enjoy-sizzurp-a-must-read/ order levitra are not limited to sexual health related to men, they really feel quite embarrassed about it and must disclose about it at least to see one through the intercourse. It improves the strength of immune system and buy viagra australia reduces the risk of health disorders. Habit of Alcohol, Smoking and other Drugs that often have serious side effects and can increase your health levitra online find that storefront now issues. One effective medication that is prescribed for overcoming this problem is related to acid production in our stomach, which due to some reasons finds its way out and moves generic cialis into throat leaving an acidic taste behind. Seasonality… June’s just around the corner, so we begin our coverage of that month’s historical performance. Using the S&P 500 historical data since 1950, it’s the 3rd worst month of the year, with average losses of -1.0% to -1.5% among the major indexes. There are always exceptions of course. Last year the S&P 500 gained just under +2%. Read more about June in this week’s Seasonality section.

Topic of the Week… A Tale of Two Pies

The Global Industry Classification Standard (GICS) quickly became the most popular of various business taxonomies shortly after it was published. Designed by the S&P indexing folks and MSCI, the GICS was prepared to modernize business classification to match the shift toward services from the industrial revolution days; and to ensure that the system was not US-centric as previous classifications have been. Hence, a more global approach as well. You can see how the top sectors break down into subgroups in the pyramid chart above. In our Topic of the Week section we look at Canadian vs US economies by the GICS breakdown of publicly traded companies. There’s a bigger difference than you might suspect.