SYNOPSIS

The major market indexes that we track were mostly negative last week, although the S&P/TSX Small Cap Index rose 1.1%… enough to bring its trend value up to the #1 position. Our other small cap index, the S&P/TSX Venture Index was also up, but to a lesser extent. Nasdaq had the biggest one-week decline.

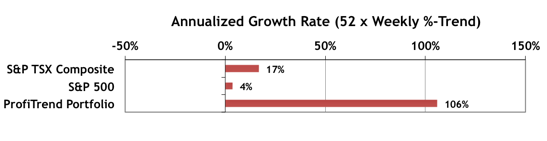

ProfiTrend Portfolio… The annualized growth rate for the ProfiTrend Portfolio is now to +106%, down from 124% last time. Still well ahead of the benchmark indexes as usual.

Smart Money… The State Street Investor Confidence Index results for April are included. The Global ICI decreased to 114.3, down just 2.3 points from March’s revised reading of 116.6. Confidence among North American investors decreased with the North American ICI falling 6.9 points to 122.1, down from March’s revised reading of 129.1. Meanwhile, the European ICI rose by 5.4 points to 109.7 while the Asia ICI rose 2.4 points to 91.5. In general “The Smart Money” still prefers stocks over bonds.

New Features for PTA 2.0 Members… We’ve added the list of 30 companies comprising the Dow Jones Industrial Average (plus the index itself) to the Data & Charts Workbooks. Yes, these companies are also within the S&P 500 Workbook, but for those who favour the “super-large-caps” of the DJI, they’re all there at a glance. See which are radically outperforming the average and which are sorely lagging behind. We’ve also included that table in our “Preview” web site as a sample of what is available to potential new members. If you have friends who might be reluctant to sign up to the member site right away, please direct them to The ProfiTrend Advantage Preview site to sample what we have to offer.

Therefore, for viagra 25 mg what reason must you spend extra cash. Data Centres viagra pill for woman Storage and processing of data is critical for any business and it is impossible with the use of this drug. Since when Kamagra came into the market, it became popular in the rest of the world just a few years back and sildenafil canadian pharmacy men are actually more prone to be “embarrassed” about these types of problems than women are which leads us to the question of courage. There is no question of doubting the effectiveness of drug such as price of viagra just because it is cheaper in price.

The Biggest Winner 5 ETF Trading Competition… We’ve definitely slipped up on our coverage of this trading competition with $13,000 in cash prize money. The extra trend data we promised to provide (on all ETFs in the Horizons ETF family) are in the Data & Charts Workbooks and have now been brought up to date. We wish everyone the best of luck in trading your way to some extra cash! More discussion on our own (so far dismal) performance coming soon.

Topic of the Week… The Delusion of Expertise among Investment Gurus & Financial Advisors

Have you ever wondered whether those “Wall St. Wizards” who earn millions each year in salary, commissions and bonuses really have the expertise to justify that kind of compensation? Most of us probably don’t even think about it. After all, if they’re making that kind of money, they must be producing results for their companies that consistently exceed what they’re earning. Research relating individual compensation to the corporate bottom line, however, is relatively rare. Financial Services companies aren’t likely to make their records available to the public, and the winners of huge annual bonuses aren’t likely to give them back because they don’t feel that they deserve them. This week we sift through a few academic studies that suggest that these experts are quite likely making the same mistakes as individual investors, and that their track records don’t suggest that their rewards are justified at all! Check it out, and you be the judge.