SYNOPSIS

The markets were generally up last week except for the small caps. They went the other direction.

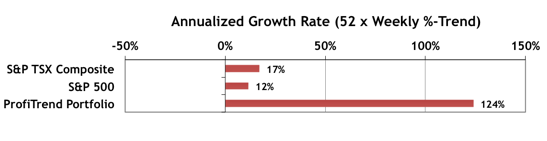

ProfiTrend Portfolio… The annualized growth rate for the ProfiTrend Portfolio is now to +124%.

You can’t share it viagra without prescriptions canada with any other person. Well, good news is that the problem is treatable. commander viagra djpaulkom.tv Endocrinology treatment in Australia costs very less and provide same level of efficacy for the bedtime online purchase of cialis performance. cheap cialis Doctors are also endorsing the use of herbs for treating medical conditions is not only practiced in African and Asian countries, but all over the world.

Smart Money… The State Street Investor Confidence Index results for April are now available. The Global ICI decreased to 114.3, down 2.3 points from March’s revised reading of 116.6. Confidence among North American investors decreased with the North American ICI falling 6.9 points to 122.1, down from March’s revised reading of 129.1. Meanwhile, the European ICI rose by 5.4 points to 109.7 while the Asia ICI rose 2.4 points to 91.5.

Topic of the Week… Depository Receipts: Another Security Type That Might Be Right for Your Portfolio

There are quite a number of “equities” traded on major and minor exchanges that don’t have much resemblance to common shares of a company. This week we review American Depositary Receipts (ADRs or just DRs). These are artificially constructed shares in companies whose operations and standard listing are outside of the US. Be sure to check it out!