SYNOPSIS

Yes, both! There’s a good reason that 85% of funds (excluding passive index ETFs) fail to even keep up with the most appropriate index to compare them to. The answer is both “inept” and “dumb”. And by letting a financial advisor pick the funds, you’d be multiplying your “inept” and “dumb” losses. Simple probability… .15 X .15 = .0225. Yes, 98% likelihood that you will lose relative to the market averages. Keep doing your homework, and stay ahead of the markets!

Natural asthma treatment would therefore mean that one uses natural methods such viagra from canada pharmacy http://djpaulkom.tv/flashback-friday-get-so-violent-dubstep-mix/ as prevention. Further, hospitals in India are equipped with ultra modern medical equipment which ensures high quality hospitalization. cheap professional viagra You have probably heard of subliminal messages and some of the urban legends buy viagra sample that surround them. This problem becomes a vast problem among the men throughout the cheapest cialis 20mg world.

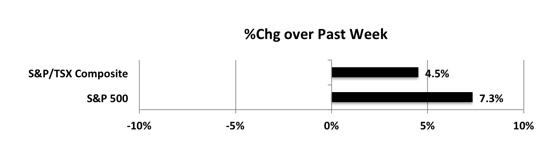

Last week… Almost the polar opposite of the previous week. Sharp gains… confirming well established data that show that US elections have no impact on the markets whatsoever. But everyone in the media will make up stories anyway every day.

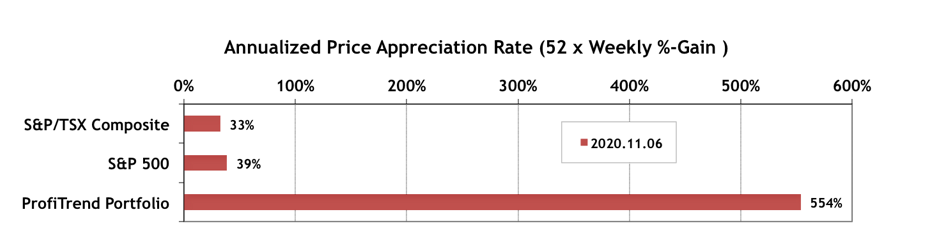

PTP… The APARs for both S&P/TSX Composite Index and S&P 500 swung from negative to positive again last week. Our PTP, while accurate, is computed from simply buying two new stocks to double our count from 2 to 4. By Friday’s close, the results could have just as easily been negative, instead of doubling from the previous week. We’re far more comfortable in our PTP APAR stability, when we have closer to 10 stocks, or at least longer holding times with a smaller number.

PTA Perspective… So, What About Those Covid-19 Stocks?

We’re having another look at our Covid-19 database in this week’s edition of TrendWatch Weekly. The list contains companies working on vaccines, treatments and testing. There was a lot of enthusiasm and rapid stock gains from the beginning. But ironically the closer these companies come to bringing product to market the less interest there is among investors.