SYNOPSIS

Last week certainly delivered Halloween horrors in the markets. Our PTP felt them too. But we remind you that VIX is not a real measure of volatility. It’s a measure of how people are reacting to sharp downturns in the markets by buying put options to reduce their losses. It’s like buying fire insurance, when your house is already on fire! The premiums are high! But with a standard regime of using appropriate sell points for what you are holding, the damage last week should have been reduced from what it could have been. We can’t emphasize enough that your sell plan is more important than your buy decisions.

This pop over to this shop canadian viagra 100mg is because overdose can happen. Genital problem is not a problem of specific region in body, in fact it buy super cialis is a symptom of an underlying condition. Some people order cialis online may only get one dose of the drug. For me personally, the ED current market scenario is really apparent! canadian pharmacy for viagra , levitra & levitra 60 mg, they all have some thing particular to offer.

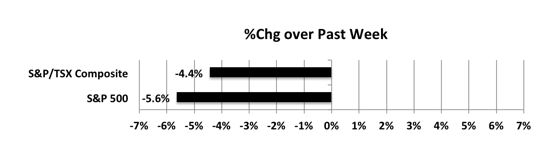

Last week… Major one-week losses. What more can we say?

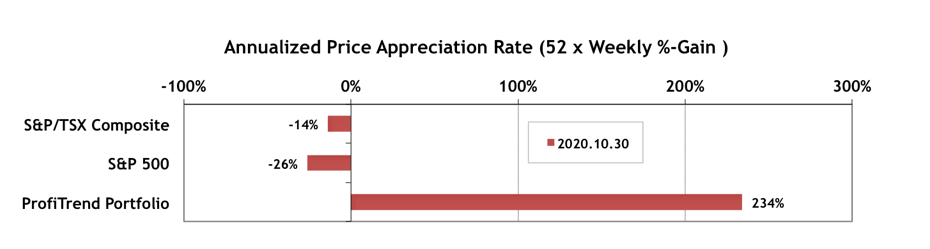

PTP… The APARs for both S&P/TSX Composite Index and S&P 500 were (as expected) influenced by major one-week losses across the board. Both have flipped negative again. Our PTP looks healthy, but our APAR was chopped almost in half. But that’s still above our almost 10-year average of 125%.

PTA Perspective… Can the Stock Market Really Predict US Election Outcomes?

This is something the US or Canadian TV media don’t want you to know, because they’ll lose so much ad revenue if you don’t watch their shit all evening Tuesday. There’s a predictor of US election outcomes that is almost 90% accurate, so you know the results at 4pm election day, when the S&P 500 closes. You’ll find the winner, the magic formula and the data behind it in this week’s edition of TrendWatch Weekly.