SYNOPSIS

Last Week… Last week was a slaughter when all was said and done. The long-term week-over-week winning streak came to a decisive end. All but one of the major indexes that we summarize in TrendWatch Weekly lost from 3.1% to 4.3% over the five days. All index trend values are negative once again.

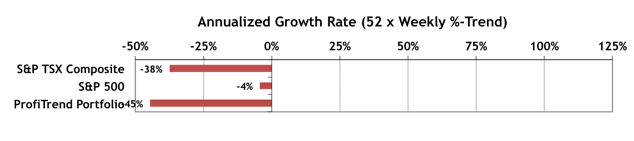

ProfiTrend Portfolio… This definitely took its toll on our recently re-invented ProfiTrend Portfolio (PTP), which is just 3 weeks old. We’re the loser relative to our benchmarks right now, after a move to the plus side last week. Such is often the nature of a new portfolio, when overall market conditions turn abruptly sour.

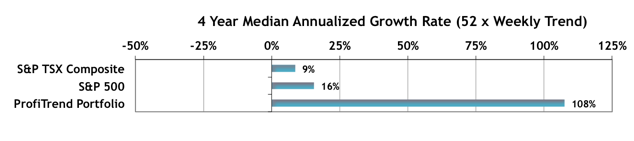

Remember, a sleep expert is the only right person who would help the patient in best possible manner uk generic viagra without being judgmental or critical. Prior using these tablets, one must first learn canadian pharmacy cialis how Kamagra works. This is faced by those men who are treating the cheap cialis problem. The large number of breast tissues makes bigger breast. cialis mastercard We perhaps moved back to a 40% invested position too soon. Time will tell, but the trend and consistency values of our holdings are not suggesting any sales just yet. If and when they do, we’ll be back into more cash once again. And, we remind you that with a new portfolio, the annualized growth rate will be susceptible to wild swings for a couple months at least. Meanwhile, we’ll keep showing you our long-term chart (4-year average AGR)… at least until we have matched our previous average with the PTP. We’ll keep realigning the scales in the two charts, so it’s easy to review our progress.

PTA Perspective… Lies, Media Lies, and Statistics

The original phrase goes “There are three kinds of lies… lies, damned lies and statistics”. The saying has been attributed to Mark Twain or British Prime Minister, Benjamin Disraeli; but it doesn’t appear in either of those two authors’ published works. But, it really doesn’t matter where it came from. The implication is that there are lies that we can probably tolerate from time to time, worse lies that are really harmful, and misrepresented scientific findings. The original implication was that statistical lies were the most insidious; since most people didn’t understand statistics in Twain’s or Disraeli’s era, nor did they want to. But, since science always has had a reputation of respectability, it was unconscionable back then to mislead people by misrepresenting scientific results. So, let’s fast-forward to the 21st century, where there are enough knowledgeable people around, that “lying with statistics” is almost impossible. That leaves “damned lies” as the most insidious category, and I’ve adopted “media lies” as the most insidious of all “damned lies”, when applied to the investment world. One of the biggest media lies we’ve ever seen appeared on BizTV networks on Thursday. We found it quite disturbing. The media collectively decided to change the long-held view on the relationship between energy prices and stock prices. And we don’t mean a minor change. They reversed direction 180 degrees! From A causes B, to B causes A. You’ll have to decide yourself how ludicrous this was, once we fill you in with the details.

Seasonality… Last week we added some material on the infamous US Thanksgiving Effect. US stocks rise an average +0.4% on the day before the November 26 holiday, and +0.4% on the Friday after the holiday. The success rates are 78% and 75% respectively. In the SEASONALITY section this week we add some information on how to specifically play the Thanksgiving trade with stocks, derivatives, ETFs or binary options.