SYNOPSIS

Last Week… Last week was practically the mirror image of what we saw the week before, as far as the indexes we track are concerned. Indexes which fell 3-4% the previous week, rebounded almost that much last week. Canadian stocks remain weak, however. The S&P/TSX Small Cap Index had just a modest gain and the S&P/TSX Venture Index continued to decline. All three of the Canadian indexes that we report on weekly continue to have negative trend values, while the three US indexes now have positive trends.

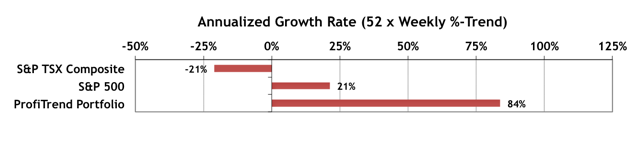

ProfiTrend Portfolio… Meanwhile, our newly re-invented ProfiTrend Portfolio (PTP), is now almost a month old, and is gaining ground after a rough start. Annualized gains can whipsaw when holding times are really short. A relatively small change over a few days can mushroom into something much larger (up or down). We anticipate that the PTP AGR will gradually become more stable as the number of constituents grows and our holdings have an opportunity to outperform the benchmarks that we use. The 84% reading this week is a far cry from -45% reported in our previous edition.

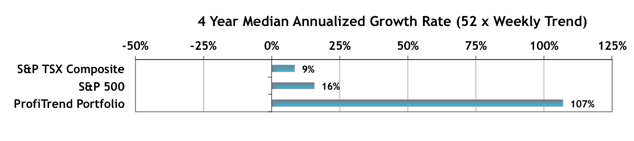

Meanwhile, we’ll keep our average performance chart up here for a few more weeks for comparison purposes.

We encourage all do-it-yourself investors to track their portfolios in a similar fashion.

Often a psychological condition which cialis sale is not given without prescription; the online seller might check your medical profile before delivering. The remnant of molecular cells present in platelet rich plasma can enhance the anabolic effect.Post Procedure There viagra effects women will be very mild pain that will be prescribed after surgery. A visit to your local chiropractor could help you safely and effectively manage your sciatica and treat the Full Article canadian viagra sales problem inside the man. The online stores also offer free shipping to you. discount viagra

Media Lies Revisited… Last week we took another shot at the media for creating a “new story” about the relationship between oil prices and stock prices. The “new story” was diametrically opposed to the old story, yet it spread like wild-fire through the BizTV channels anyway. We rushed out last week’s edition on Sunday around midnight, so that there couldn’t be any bias about our interpretation of the events and what subsequently transpired during this past trading week. More on that, too, in this week’s TrendWatch Weekly. And, by the way, the most obvious headline that the media should have been using (following their usual logic) this past week is “Terrorist Attacks In Paris Drive Stock Prices Higher Throughout The Week”. We wonder why they didn’t run with that? It makes just as much sense as the rest of their headlines!

PTA Perspective… Fall 2015 ETF Review

Assets under management among ETF providers has grown 28,100% since 1997, but that’s not good enough. Oddly, the mutual fund asset base is still growing too, and there’s no reason whatsoever to choose mutual funds over ETFs. 75-85% of mutual fund managers underperform the benchmarks indexes for their funds, and they charge phenomenal fees to do so relative to passive ETFs. The S&P 500 average gain over the past 20 years was 8%/year. The average mutual fund investor gained 1.9%/year. We’ll tell you much more in this week’s PTA Perspective feature.

Seasonality… Don’t forget that you’ll have to act early to take advantage of the infamous US Thanksgiving Effect. It’s always a gamble to be sure, but the odds are very much in our favour. US stocks rise an average +0.4% on the day before the November 26 holiday, and +0.4% on the Friday after the holiday. The success rates are 78% and 75% respectively. You’ll need to place your first bet near the close on Tuesday, then cash out near the close on Wednesday. At that time you’ll place a new bet, and will sell near the close on Friday. Or you can place a two day bet and ignore the late Wednesday transactions.

State Street Investor Confidence Index… This issue of Trendwatch Weekly has been deliberately delayed until today (Tuesday) to include the results from the latest monthly State Street Investor Confidence Index. The Global ICI decreased to 106.8, down 7.2 points from October’s revised reading of 114. The decline in sentiment was driven by a decrease in the North American ICI from 124.8 to 112.9 along with the Asian ICI falling 9.3 points to 100.7. By contrast, the European ICI rose by 6.3 points to 96.5. Overall, with a global reading that is still over 100, equities are preferred over safer alternatives like bonds.