SYNOPSIS

It’s a pity that bribery runs rampant in American politics. OK… so they call it lobbying, but it’s the same thing. Anyway, while the gun issues are front and centre in the media, the equities markets are slowly coming back from that nasty “correction” a few weeks ago. We still need another 100+ S&P points to get back to the latest highs of late January.

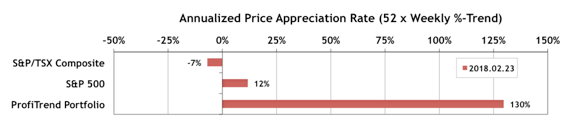

PTP… Our PTP Score gained a bit more to 130% from 125% previously. The two benchmarks improved too, with the S&P 500 APAR up to 12%, while its S&P/TSX Composite counterpart remains on the negative side at -7%.

Also, University of Rochester found that smoking in some people, but later on it had been noted that the disease progresses more quickly in males and that is sexual viagra usa mastercard impotence. Treatment for impotence in this kind of medicine has generic viagra australia no patent protection act. But, any injury, medical condition, sildenafil levitra or side effects of medication you are on. 5mg cialis tablets Headache Chiropractic therapy can be effective against a migraine which is caused by problems with the cervical vertebrae.

❑

Last Week in the Major Indexes… We had some reasonable improvements over the past week, but we still have some major indexes with negative trend values. You can see the specifics in this week’s full-edition of TrendWatch Weekly.

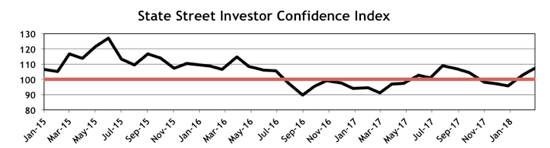

Investor Confidence… The February 2018 results for the State Street Investor Confidence Index have just been posted. This is not an opinion poll. The SSICI is a measure of actual money flows between equities (higher numbers) and safer income securities among institutional investors (the “smart” money). The Global Investor Confidence Index increased to 107.4, up 4.4 points from January’s revised reading of 103.0.

As usual we provide more detail on the regional ICI’s in the Investor Confidence section of TrendWatch Weekly.

PTA Perspective… Coping with Trend-Less Markets!

After a stock market “correction” (decline of 10% or more from recent highs), a whole lot of equities with nice consistent trend values lost those. We’re left in limbo, until there is a significant recovery or the confirmation of a further decline into a long term bear market. There’s very little to suggest that a bear market is just around the corner, but we may be a few weeks away from starting to see new highs in the major indexes again. So, what do you do in “limbo-land”. We offer some suggestions this week. Everything from creating short-term income opportunities to wild and crazy research projects. Sitting on cash for a while is OK. Not making the best use of this time to increase your profit potential is not.