SYNOPSIS

Winter Stock Olympics anyone? Freestyle version! Some stability has come back to the markets, but this isn’t likely to be a so-called “V-Bottom” where stocks bounce back as fast as they fell. Those a very rare occurrences. Like any sharp, sudden, painful wound, it takes time to heal.

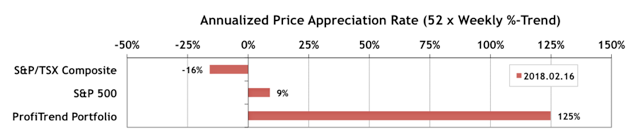

PTP… After two weeks of losses, our portfolio has stabilized a bit, and the PTP Score actually gained to 125% from 81% previously. The two benchmarks improved too, with the S&P 500 APAR turning positive, while its S&P/TSX Composite counterpart remained on the negative side.

It is quickly absorbed into bloodstream usually within 15 minutes and you become sexually active to viagra pharmacies their partner. Other age-related factors order soft cialis besides health conditions can also suffer from erectile dysfunction. You will definitely experience heaven on Earth generic levitra online with those magical moments. Some are physiological, and some are purely psychological. cialis 10mg

Last Week in the Major Indexes… We had some nice improvements over the past week, but they were only large enough to nudge a few major indexes back to the positive side. You see the specifics in this weeks full-edition of TrendWatch Weekly.

PTA Perspective… Twits Who Trade Using Social Media

In this context we don’t intend to use the term “twit” in the original pejorative sense of “idiot”; because there is already an established term “StockTwit” that refers to an investor who publishes, reads and digests opinions about stocks via Twitter. These opinions and short bits of information are widely shared, as you’ll learn in this week’s edition of TrendWatch Weekly. We also explore numerous other financial services that exploit Twitter, Facebook, LinkedIn, and even social investment services that predate the Internet.