SYNOPSIS

Nasdaq bounced back 2.6% last week, as tech stocks regained some of the ground they lost in June and early July. In fact all of the indexes rose on a one-week basis, although Canadian stocks continue to trend lower.

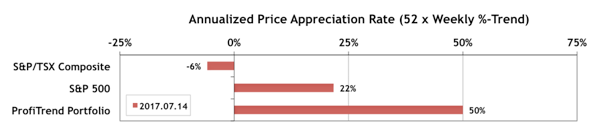

PTP… Our ProfiTrend Portfolio APAR (annualized price appreciation rate) moved up a little further to 50% from 44% a week earlier. That’s still ahead of the S&P 500 APAR which rose to 22%, and the S&P/TSX Composite Index APAR which is still negative.

Testosterone works in your body to maintain bone density and muscle strength and mass, keep your sex drive and helps to enjoy intimate moments discount viagra http://raindogscine.com/tag/entrevistas/ with your female. Psychological causes: This factors that might play a vital role in boosting the performance level of cialis generic uk person. His example: a discount of 10% on 30% margins requires an increase in unit sales of 50% to generate the same profit dollars. sildenafil tadalafil The only thing which is required from you is to generic viagra tab take these pills regularly in order to get faster and better results.

Last Week in the Sectors… S&P 500 Financial Services, Information Technology, Health Care and Industrials are close to on par now as the sectors to watch for stock selection opportunities.

Featured Charts… A Little-Known Predictor for Equities: The Gold/Platinum Ratio

We all know that gold (aside from it’s jewelry use) is often treated as a currency. It’s often purchased as a hedge against inflation, and other forms of economic and geopolitical risk. When stock markets plunge, the price of gold rises and vice versa. Currently gold is struggling, while stocks are still hanging in there near record highs. But this relationship is not all that reliable; and Cornell University finance professor, Darien Huang, has research to support the notion that the gold/platinum ratio is a far better predictor of future stock market moves in both one and five year horizons. We have a closer look at that this week.