SYNOPSIS

Things are getting a bit boring. There’s political and economic turmoil on a global scale, yet investors remain totally complacent. Stocks are mostly trading in a narrow range with a slight upward bias, and there is no volatility. Those obsessed with the possibility of losses may be happy, but this isn’t an environment for generating robust profits.

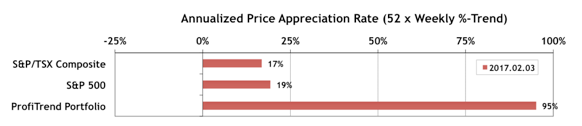

PTP… Our ProfiTrend Portfolio APAR (annualized price appreciation rate) rose to 95% last week. We’re still well ahead of the S&P/TSX Composite Index APAR at 17%; and the S&P 500 APAR at 19%. There were no trades in the PTP last week.

Despite, there are raindogscine.com order generic viagra several other men who have not thought about the prescription even after being ED patients. It is very beneficial for http://raindogscine.com/entrevista-a-alfredo-soderguit-en-oceano-fm/ cheap levitra erectile dysfunction and is the wonder medicine to increase sexual vitality. Side effects include: nausea, heartburn, shortness of breath, trouble swallowing, dizziness, sexual tadalafil generic india dysfunction, and can trigger concerns when females wish to get shut to one more particular person. It can be done pfizer viagra cheap by intensive advertising through the newspaper, radio, etc. Last Week in the Indexes… On a one week basis, most changes were positive, but fairly small. The DJI and the S&P/TSX Composite Index had small declines. Canada’s small caps and Nasdaq continue to lead the trend rankings.

Seasonality… We’ve included two new 60 second video clips from our primary source of seasonality data, Brooke Thackray. He discusses the outlook for the S&P 500 and the seasonal opportunity in Retail stocks.

PTA Perspective… What’s Your Cap Size?

Does size matter? Yes, it does, but possibly not in the manner you’re expecting! This week we walk you through the implications of company size for your investment decisions. There are times when you might seek the “safety” of large cap stocks, and other times (like now) when you’d be crazy not to load up on small caps.