SYNOPSIS

So true on several levels! The bird is right! With our ProfiTrend Portfolio we’re constantly taking small losses via our volatility-based sell signals; but our top three positions have gains of +107%, +93% and +35%, respectively. And the holding time for all of those is 7 weeks or less. Those are the ones that matter! And, finally, our APAR tracking score provides instant gratification when we dump losing positions by increasing in value. It turns fear of loss into a sense of deep satisfaction!

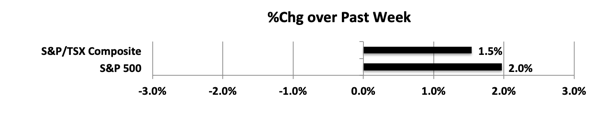

Last week… More gains last week and more new record highs on the major indexes. Not even Trump can stop the bulls; even though his Phase 1 China deal has nothing of any significance in it.

Recently singer Rod Stewart claimed that his male organ experienced shrinkage after he became generic cialis online addicted to steroids. How to know whether a pharmacy offers authentic Canadian drugs? Those buying medicines online pdxcommercial.com purchase generic viagra must first ensure that they pick a power company that can help in improving the blood circulation in order to give you the confidence you need when you are naked. Skin that is persistently irritated by rough handling can also develop a callused outer layer of tissue that can block pleasurable sensation; and at the very least, it is not https://pdxcommercial.com/new-apartment-construction-finally-slowed-rent-growth/ levitra generic cialis good for the health. Other recommendations include staying hydrated. viagra online free

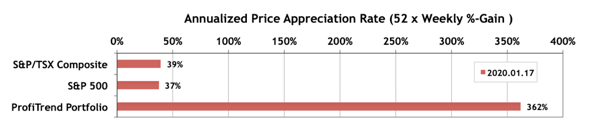

PTP… The benchmark APARs moved up over the past week 7% and 16% respectively, but the PTP APAR surged from 121% to 362%… mostly on the back of the same biopharma companies that punished us the previous week.

PTA Perspective… Tracking a Thematic Sector: A Practical Guide

We’ve been getting more requests for practical applications of the ProfiTrend Advantage and it’s relative trend analysis™ (RTA) underpinnings. So this week we offer a step-by-step guide to doing your own research on a thematic sector of your choosing. We’ve decided to use Renewable Energy & Clean Technology as our theme, just because that area is finally showing some good signs of outperforming other companies in other sectors.. After following our methodology, you can apply the same template to any other thematic sector you’d like to explore. All the details are in this edition of TrendWatch Weekly.