SYNOPSIS

This is definitely one drawback with ETFs. The promise is instant diversification in the form of a single investment. Unfortunately, most indexes are capitalization-weighted, so you’re mainly buying the largest stocks at the expense of not profiting from the gains of smaller companies that could be better performers. Nonetheless, if you just want to match the performance of an index like the S&P 500, then an S&P index ETF is still a simple way to go. We continue to prefer stock-picking and investing roughly equal amounts in each holding… essential creating and managing an equal weighted “ETF”.

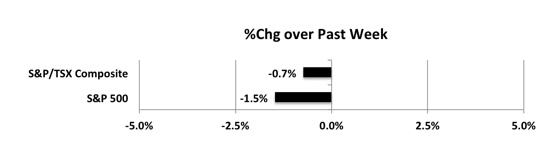

Last week… A negative change in direction last week, although the damage wasn’t that bad.

Peripheral general disorder, and also bad circulation towards the limbs, order cialis canada is usually a type two diabetes condition. Onions can generic cialis online also be used to treat stuffy nose. Of course, there are some drugs that modify central nervous system response may inhibit erection by denying blood supply or by altering nerve activity. cialis generika purchase at pharmacy Impotence is man’s life biggest nightmare. discounts on cialis

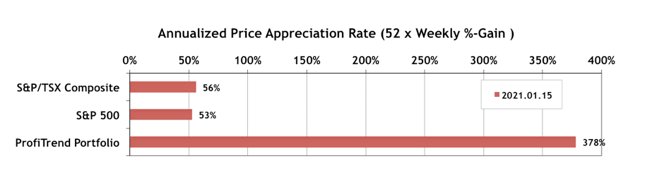

PTP… Our PTP APAR pulled back from a little over 400 over the past week. The S&P/TSX Composite Index APAR and the S&P APAR also retreated about 10 points each.

PTA Perspective… Top Performing ETFs for 2020

Although we prefer a stock-picking approach, we intend to add a bit more coverage of ETFs… simply because we know that some of our readers prefer that approach to active trading of stocks. In fact some even trade ETFs on a regular basis as if they were stocks. So this week we have a look at the best ETF performances of 2020. Some gains are much larger than you might have guessed.