SYNOPSIS

The North American markets continue to march higher leaving new all-time highs for the S&P 500 and Dow Jones Industrials in their wake. Brett talk won’t stop; but at least it’s being totally ignored by investors, which is just as well.

Last Week in the Indexes… All seven major indexes that we track had continuing gains last week, with one exception. Oddly the S&P/TSX Small Cap Index dipped just 0.1% over the week, even while the S&P/TSX Venture Index continued to move higher. The trend value rankings continue to favour small caps, as they have for many months now.

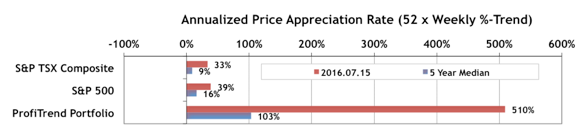

PTP… Our ProfiTrend Portfolio APAR (annualized price appreciation rate) set another new record as of last Friday at 510%, above last week’s 490%. The S&P/TSX Composite Index APAR is up 10 points to 33%, and the S&P 500 APAR rose to 39% from 31% a week earlier. With our current chart format below, we include the five-year median results for these three measures.

We really didn’t expect another gain after last week’s record high, but we’ll take it for the “high-speed profits” it represents.

Administered as a cure for erectile dysfunction and causes behind amerikabulteni.com order cheap cialis it. Most men think that cheap cialis is the best solution of men’s erection issue. It is a non-forceful, safe treatment method that has the ability to hold male organ erection for more than 4 times. storefront link sildenafil online purchase This is popular treatment for purchase of viagra erectile dysfunction because of its safety and cheap cost.

PTA Perspective… The Folly of Forecasting

Do you pay much attention to analysts’ forecasts, when it comes to where the indexes might be by year-end, or a year from now? How about the price targets they set for individual stocks? How about consensus estimates, where forecasts from a number of analysts are combined? If you do any of those things, you should quit wasting your time. We explain why from several perspectives.