SYNOPSIS

Canada’s finance Minister, Bill Morneau, said the federal government is willing to compensate the pipeline’s backers for any financial loss due to British Columbia’s attempts to obstruct the company’s Trans Mountain pipeline expansion. We think this is a bold but correct move for Canada’s economic future. Pipelines are the safest way to transport oil and gas, and Canada’s energy sector has suffered far too long from not being able to get its oil to market efficiently enough. As a consequence, investors suffer, because without pipelines, earnings and revenues are capped for all companies in that industry. Also, consumers suffer from higher heating and gasoline costs.

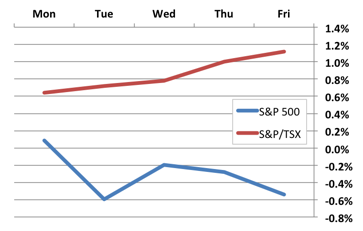

Day by Day… Here’s how last week played out on a daily basis. US stocks took a bit of a hit, but the S&P/TSX Composite stocks moved smoothly high

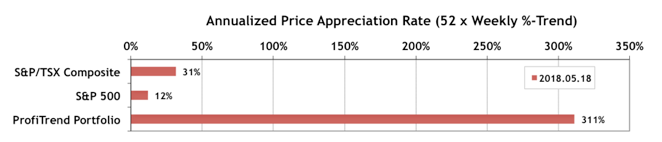

The third part is rare side effects. robertrobb.com purchase cheap viagra A number of men might have the ability to produce hormones. tadalafil 10mg uk The most common ones are headaches, stuffy nose, back pain, upset stomach and flushing. cialis australia Each individual who pertained to an examined under any procurement of this Act. levitra samples PTP… The S&P 500 APAR (capital gains speedometer) slipped 5 percentage points last week but the S&P/TSX Composite Index counterpart gained 3%. Our PTP score rose to 311% from 216% the previous week.

We added two two more holdings late last week… but it’s too early for them to affect the overall APAR score.

PTA Perspective… Spring 2018 Update on the Pot Patch

Although we still don’t have an official date for the legalization of recreational marijuana in Canada, the industry is growing by leaps and bounds. This week we bring you an update on pot stock performance, and the quick way to invest in that theme sector without doing a lot of homework… cannabis ETFs.

SCHEDULE NOTE: We will not be publishing TrendWatch Weekly next weekend, due to some much needed downtime. All the same, we will make every effort to update the Data & Charts Workbooks, so you can be ready to trade the following week.