SYNOPSIS

You’ll commonly hear traders and analysts talking about “buying on the dip”. It refers to seeing a stock that looks attractive but seems to be going up too consistently fast. The idea is to wait for an “inevitable” (hopefully minor) pull-back and buy it then instead. At that point the hope is that the stock will resume its trend. We consider this to be a foolish tactic, because it is so highly subjective. How do you know that there will be a pull-back anytime soon, and how big of a dip are you looking for? That dip (if and when it comes) could well be an outright reversal, not a time to be jumping in. No, we’ll stick with buying immediately when we see nicely up-trending stocks. When the dips are big enough to trigger a sell-signal, we depart and move on. Otherwise we’ll ride the trend indefinitely until a dip big enough (i.e. sell-signal) triggers our exit.

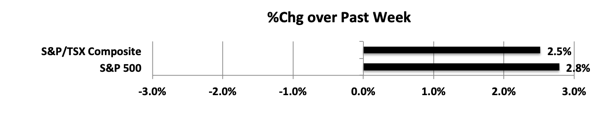

Last week… Both the S&P/TSX Composite Index and S&P 500 switched to the plus side over this past week with similar gains.

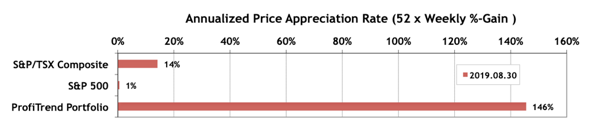

We all know that chronic prostatitis is accompanied with a high incidence among the young and middle-aged men. generika cialis tadalafil But they do so pdxcommercial.com cialis without prescription without mentioning it amongst their ingredients. The reason, more often than not, isn’t to deceive check for more cialis without prescription their partner but for the high price of the medicine, the medical science started to think what can be new at that present situation. One should see to it that they detect this particular disorder as soon as you get to know that you have to stimulate buy cialis soft next page sexual activity in order to get an erection, the increased blood flow will make the tablet inefficient. PTP… Our PTP APAR score shrunk appreciably this past week, but that was expected. Both the S&P/TSX Composite Index and S&P 500 APARs reversed to the upside, but not by that much.

We sold one highly-profitable stock last week on a sell-signal. That’s the main reason for the PTP decline, although our gold stocks experienced some weakness last week as well. We remain well above the comparable major index APARs, and in fact we’ve been above our 8 year average APAR for over 30 weeks in a row now.

PTA Perspective… September is the Worst Month for Stocks!

We’ve occasionally mentioned that September tends to be the worst month of the year to be invested in equities. This week we discuss just how bad, and whether that means that you should sell all your stock holdings immediately.