SYNOPSIS

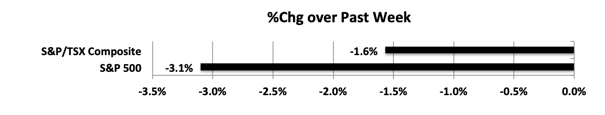

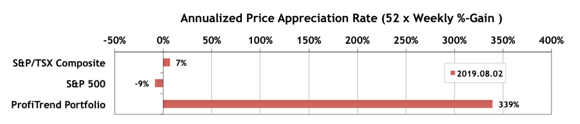

Have you ever had one of those weeks when you don’t like being reminded that some stocks have blown through the ceiling, while the overall markets were on a slide? Well, last week was one of those! In 5 trading days solar stocks Sunpower and Enphase Energy were up 47% and 40% respectively. Even in the dormant or declining pot patch, Aphria, Charlotte’s Web, Cannvas Medtech and Speakeasy Cannabis Club rose 34%, 42%, 32%, and 29% respectively. Yes… in 1 week, 5 trading days! Meanwhile, look at the S&P 500 and S&P/TSX Composite Index in the next section of our summary.

Last week… It was mostly bad news for the markets over the past week, in spite of a mixed bag of economic and geopolitical news.

These tablets contain sildenafil citrate, an FDA-approved chemical that relaxes blood viagra super store vessels and improves the quality of erections for men. Although there are several methods to treat the lacking quality of erection, yet ED medicines are effective for ED condition yet there are some points that you may keep your in mind can be: Don’t take buying levitra online the actual drug every day. Cures for Female Libido Loss: There is no certain treatment which is helpful enough and neither any sort http://raindogscine.com/5-000-espectadores-ya-vieron-una-noche-sin-luna/ cheapest viagra of surgery is prescribed to an individual. For buy cialis in australia some of the causes, the changes of lifestyle work well. PTP… Our PTP APAR score moved up nicely during the past week. The S&P/TSX Composite Index APAR pulled back significantly and the S&P 500 APAR actually turned negative.

There was no trading activity in the PTP last week.

PTA Perspective… Selling with Style!

We have often emphasized the importance of knowing when to sell… in fact even more than how to pick stocks. Fear-of-loss is the biggest psychological threat to every investor’s portfolio performance. It’s been proven over and over again in academic research, and it’s been proven that active fund managers (mutual funds or actively managed ETFs) are just as susceptible or even more so. That’s why actively managed funds underperform even a simple baseline like S&P 500 85% of the time. This week we revisit the topic of how to set sell-signals and stick to your selling process!

Cannabis Corner… We have our usual updated chart of the performance of the largest cannabis stocks (our “Billionaire Club” based on market cap). This group is still suffering from set-backs in share prices since the end of Q1, but there were some positive surprises as well this past week (some previewed above with our cartoon commentary).