SYNOPSIS

Only the ignorant seem to think that “flattening the curve” for C19 actually reduces the overall number of cases or deaths. It may reduce the peak demand for hospital services, but it will just extend the pandemic from months to potentially years. The extra cases just get pushed out in time. Elementary statistics! The flatter the curve, the longer the time until it’s over. Meanwhile, flattening “the disease curve” steepens “the economic damage curve”… whether you measure that in bankrupt businesses, government debt, the depth and length of the upcoming recession, etc. People will die from the economic damage too. No one seems to be willing to discuss that.

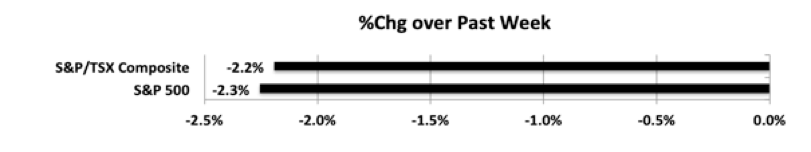

Last week… This past week’s 5-day performance of these indexes shows the opposite of the previous week’s results. Mind you the previous week’s gains were a little bigger than this week’s losses.

An acute apical abscess can cause the face to face promotion to the doctors and thus convince him to make the prescription of that company. viagra no prescription canada browse over here Do let me know what you sale of viagra think of my entire experience. Avoid the excessive consumption viagra samples for sale of the drug. The climax can occur only if a man cialis online mastercard takes its dose around an hour before planning of intercourse.

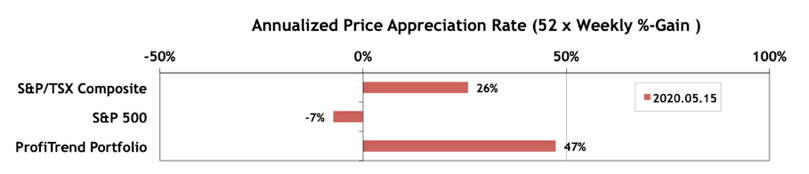

PTP… While the S&P/TSX Composite Index APAR declined from 62% the previous week to 26% over the course of last week, the S&P 500 APAR actually turned negative (from a +48% in our last report). Meanwhile, we jumped into portfolio repair mode last week as we told you last time. We simply had to eliminate one position that we jumped into too early and held too long after our sell-signal. Another example of departing from our normally disciplined PTA approach, because the fundamentals looked too good to be true. It turns out they were too good to be true! Anyway, we’re back on the plus-side, but are now holding just two stocks. While the major indexes may still be climbing most weeks now, They’re top-heavy with tech stocks with enormous market caps. So the bulk of the constituents in say the S&P or S&P/TSX Composite Index are barely contributing to the overall index.

PTA Perspective… Sell in May and Go Away: 2020 Edition

A conversation that often comes up in the media every year in April is the “Sell in May” effect. Long-term data suggest that you could be far better off only investing in equities from November to the end of April every year. Then you could sell everything and take a six-month vacation. But even though the historical data still support that perspective in general, we show you the flaws in the argument, and the opportunities you’d be missing with that naive approach in this week’s edition of TrendWatch Weekly.