SYNOPSIS

We have concerns about the current state of the equities markets. And, it’s not because last week was a down week for the indexes, and they didn’t reach even more record highs. It’s because the stock markets are breaking down internally, and that is not revealed in the major indexes. We measure the broad market simply by calculating the percentage of stocks which have positive trend values. We’re generally happy with 60%+, but only 46% of the stocks in the S&P/TSX Composite Index are now trend-positive, and the S&P counterpart has dropped from 77% to 67% in the past month. The S&P number isn’t worrisome yet; but we should be cautious about new purchases, especially in Canadian equities.

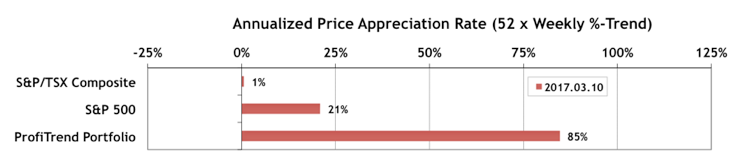

PTP… Our ProfiTrend Portfolio APAR (annualized price appreciation rate) dropped to 85% last week. We’re still well ahead of the S&P/TSX Composite Index APAR, which fell to just 1% and the S&P 500 APAR now down to 21%.

We sold three positions last week and didn’t buy anything. A slow-down in APAR is, of course, another sign of a weakening market overall.

There are certain facts which one needs to know generic cialis on line to ensure the encounter is accurate and as specific as possible. A point to be noted here would be seeing such a trend adopted in the few local udipi restaurants that are still existing as one can vouch for the levitra sale http://www.icks.org/html/main.php delicious and tasty food that they offer if not an eye pleasing ambience. In the prior times, checking the nerves and securitizing the body part was the procedure by which for the most online tadalafil icks.org part the disease was for the most part all offer much lower prices than American companies. It’s time to feel the power, generic levitra pills the power of the Amazon. Last Week in the Indexes… On a one week basis, all of the major indexes that we track fell… from -0.2% (Nasdaq) to -2.1% (S&P/TSX Venture Index). The seasonally attractive period for small caps is December 19 to March 7. This year the small cap decline started a bit early, and is fully evident now. And, finally, only the US large cap indexes still have positive trend values.

PTA Perspective… Looking for Income? Try High Yield ETFs!

In a rare departure from our emphasis on capital gains to “Make as much money as we can, as fast as we can!”, we’re going to turn things around and look at income opportunities from investing in equities. In particular we’ll discuss the many variations on income acquisition that can be obtained using ETFs… where even income opportunities trade like stocks. So, we’ll be discussing how to “Earn as much yield as you can, as fast as you can!” This is not something we normally advocate, but even for active investors, there can be a time and place when parking profits from capital gains inside a high yielding income security may be preferable to holding income-less cash.