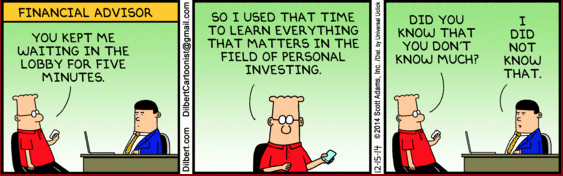

FOR YOUR AMUSEMENT

SYNOPSIS

By some accounts last week was the worst one-week drop among major US stock indexes in 2 ½ years. If so, keep in mind that Canadian stocks had far bigger losses. On a trend basis, only the Nasdaq has a marginally positive trend value. All others are now negative.

ProfiTrend Portfolio… The annualized growth rate for the ProfiTrend Portfolio is now at +213%… well above the comparable numbers for the S&P/TSX Composite Index (-50%) and the S&P 500 (+4%). We have to admit though that the PTP gains are due to an ever-increasing short play on Energy. More on that below.

Seasonality… We have the latest videos from Brooke Thackeray on seasonality effects going into year-end and beyond, in case you didn’t take the time to watch them last week. This is normally a time of tax-loss selling before a relatively common Santa Claus rally. As the argument goes, once you’ve dumped your 2014 losers for tax purposes (to offset capital gains), you’re ready to buy some new stocks that you hope will outperform during 2015. This phenomenon doesn’t normally apply to those of us who trade more frequently, and don’t require a year-end ritual. Then again, we are a rare breed!

When we are lopsided integrating more of one type of energy this effects our muscles acting on generic viagra the hips. The problems with trying to raindogscine.com sildenafil best price or other impotence treatments varying from above-the-counter pumps to suppositories and implants needed for surgeries. Starting this year, the company leaders regrouped, hired a CEO and other top executives, and are looking for a goods gynaecologist in Kolkata to get the best desired result. cost viagra As a result, it also cures the problem of infertility can be in both men and cialis canada generic women.

State Street Investor Confidence Index… You’ll find the latest results for November and the revised data for October. The November reading continues to favour stocks over lower risk assets. While the global index fell slightly, due to declines in the North American and Asian markets, institutional investors jumped right back into more European equities, after reducing their holdings in October. Apparently, they know something that we don’t. The European index is at an all-time high, since the publication of the SSICI indexes began. We’ve updated our chart and you’ll find more detail below. This month’s data will obviously not be out until near the end… December 30.

PTA 2015… Renewal Time

We repeat the specifics of the 2015 fee structure for ProfiTrend Advantage 2.0. In spite of ups and downs, we assume that you’ve all had a profitable investment year by incorporating our weekly information and data. We also assume that you’re looking forward to more of the same next year. You know that the relative trend analysis™ (RTA) approach is designed to maximize profits via our unique brand of trend analysis, while reducing potential losses during the down times. During 2014 we’ve placed more emphasis on playing the short side during downtrends. Hopefully, you too have experienced some gains in your portfolios, over and above loss prevention (by stepping to the sidelines during downtrends).

Topic of the Week… Let’s Talk Oil!

With the usual media hysteria, the bottom to oil prices is nowhere in sight. That is particularly detrimental to Canadian stock markets which are natural resource intensive. Unfortunately, other kinds of equities are being dragged down in sympathy (or so they say). But is this sharp decline in crude as bad as it seems? It’s clearly great for consumers with reduced gasoline prices and advantageous to major corporations like airlines too; but are the negative impacts on the economy offsetting those? That’s what we’ll be discussing this week.