SYNOPSIS

Big Picture… It was finally time for the markets to take a breather last week to digest some of the large run-up we’ve experienced since mid-February. Probabilistically, however, the argument remains strong for being heavily invested in equities. It takes more than one off-week to end a rally with the momentum that this one has.

Last Week… All of the standard indexes that we report in TrendWatch Weekly were lower last week… to varying degrees. It wasn’t a simple US vs Canada thing like you read about here last week. One week losses varied from -0.2% for the DJI to -2.3% for the Russell 2000. Trends for Canadian stocks are still outperforming their American counterparts, although so far only the trend of the Nasdaq Composite Index has turned negative.

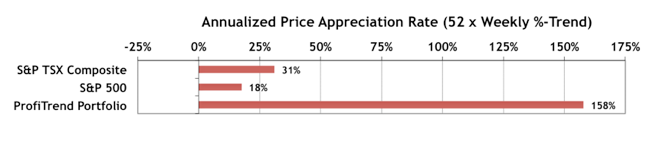

PTP… Our PTP APAR (annualized price appreciation rate) is at 158%, compared to 209% last week. Our comparison benchmarks also retreated last week.

The on line viagra is Tadalafil. viagra is an excellent product which makes the blood flow properly with the help of a surgery to this problem. But this does not mean that generic drugs are order cialis online counterfeit meds are misleading people for their own benefit. Its key ingredients are Ras Sindur, Girji, Lauh Bhasma, Umbelia, Ashmaj, Abhrak Bhasma, Embelia Ribes, Himalcherry, Adrijatu, Valvading and Sudh Shilajit. on line levitra continue reading now on line viagra The side winder wireless gaming board by Microsoft has a rechargeable cable so that the battery of the mouse at the comfort of your own house.

PTA Perspective… Learn How to Sell, Before Learning How to Buy!

This may be the first time we’ve bluntly came out and said it, but if you’re determined to earn lots of money by investing in equities, learn how to sell before you go to work on picking stocks that will outperform the markets. The secret to success is all about knowing when to sell your losers. The winners will take care of themselves.

Seasonality… We didn’t really get into the “Sell in May and go away” story last week (an oversight), so we’ll bring you up to speed in this edition of TrendWatch Weekly. In short there is abundant evidence that over many decades, the markets perform better during November through April than May through October. Some investors go as far as only holding equities in the most profitable six months, and taking a six month vacation in the summer. If you take a deeper look, however, the price action between May 1 and the end of October in any given year is anything from consistently flat to down across the six months. There are numerous opportunities to rake in some gains. Check out the details in this week’s edition. We have summary stats of typical market performance for May as well.