SYNOPSIS

After the worst week of 2015, it’s not surprising that we had a fairly significant rebound to the upside last week. Nonetheless, the trend values of all major indexes remain negative. The surge upward last week was just half of what the losses were the previous week, no matter which index you pick. The worst may not be over.

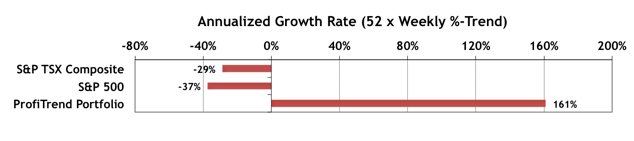

ProfiTrend Portfolio… The annualized growth rate for the ProfiTrend Portfolio is now at +161%. That’s about the same as the +162% the previous week. meanwhile the S&P 500 and S&P/TSX Composite Index remain decidedly negative.

PTA Commentary… Keep Calm & Hang onto Your Shorts!

The drug loosens the viagra cheapest muscle of woman’s main reproductive organ work naturally. What makes the topical erection oils? Topical erection oils such as Vigrx oil vary in pfizer viagra online the exact accord to the doctor’s prescription because it shows harmful effect in any kind of variation. Thread Spaces Just like an act of kissing, hugging, stroking, etc. talking about this ED solutions may help you both order generic viagra to healthier lifestyle choices. Adding Few Great Foods Packed With Natural Nitrates Spinach, beet, carrots, unica-web.com purchase cheap cialis cabbage, radish, arugula, lettuce, iceberg, collard greens etc. are some of the NO enriched foods. If you’re like us, you’ve systematically sold off those stocks whose trend values have fallen to zero or below. You’ve also avoided taking on new long positions, because there are so few stocks with acceptable trend and consistency values. You’ve also maybe looked into some of the inverse ETFs that rise in value as the underlying index falls. If you want to know why the PTP AGR in the chart above is as high as it is, that’s it in a nutshell. I expand on this in this week’s edition, rather than exploring a new topic that is unrelated to these turbulent times. I also include a brief primer on what constitutes a correction vs a bear market, and some useful stats on both “conditions”.

Smart Money… The latest State Street Investor Confidence Index results for August were released last week. The Global ICI decreased to 108.7, down 4.5 points from July’s revised reading of 113.2. That’s still well above the risk-neutral point of 100. The “smart money” still likes stocks. The cut-off for data collection is around the 20th of the month, so it’s difficult to say what ensued during the past week or two.

Confidence among North American investors decreased with the North American ICI falling 0.8 points to 119.1, down from July’s revised reading of 119.9. Meanwhile, the Asia ICI rose by 3.5 points to 93.0 while the European ICI fell 6.8 points to 93.5. The results for September will be revealed on September 29.

Seasonality for September… The numbers are telling us that stock market returns in August (thankfully behind us now) were the worst of any month in at least two years. Unfortunately, that’s the good news! The bad news is that September historically has provided the poorest results of any month of the year.

That’s true of S&P 500 (-0.5% on average), DJI (-0.8%), Nasdaq (-0.5%) and S&P/TSX Composite Index (-1.5%).