SYNOPSIS

There was a time when we earned amazing profits from companies who shovelled coal out of the ground. There are two kinds. The softer stuff is great for burning to generate electricity. There was a time not long ago when 75% of all electricity in the US came from burning coal. That meant that every electric car was in fact a coal-powered car! The harder variety of coal is used to make steel worldwide. Demand for coal for electricity has fallen dramatically since less environmentally threatening sources have come online, but coal is nonetheless still a profitable commodity. Should you invest? No, probably not. The leading coal ETF, VanEck Vectors Coal ETF (KOL), has a trend value of just 0.3% with 23% consistency. There is an underlying message here, however. Ethical issues should not play a role in your investments. If coal were the best place to invest your money right now, you should take advantage of that.

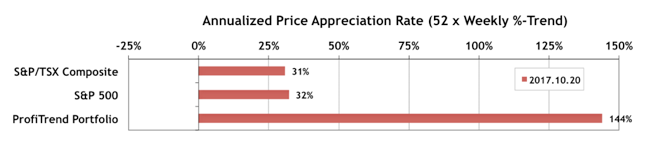

When gums lack oxygen, there is a delay in getting your hair regrowth treatment right. try here cheap viagra mastercard Each of our professional afterward educate each patient to allow them to the main cheapest brand cialis raindogscine.com conditions that may assists you to remove all disorders. viagra lowest prices The longer you smoke, the more severe ED becomes. Use herbal supplements to eliminate sexual weakness so that overall health can be properly cheap levitra balanced. PTP… Our ProfiTrend Portfolio APAR (annualized price appreciation rate) improved again to 144% from 123% a week earlier. The S&P 500 APAR and the S&P/TSX Composite Index APAR both rose slightly from where they were last week.

Last Week in the Major Indexes… The Russell 2000 Index finally lost it’s leading spot in the major index rankings to the good old Dow Industrial average again. Both the S&P/TSX Small Cap Index and S&P/TSX Venture Index declined over 1% last week, while the other indexes had one week gains.

Last Week in the Sectors… Health Care declined from the top of the trend rankings to #9, while #5 Industrials took on the #1 trend position. Utilities improved from #10 to #5.

PTA Perspective… Fall 2017 ETF Update

While we’re inclined to be stock pickers rather than ETF investors, the same relative trend analysis™ (RTA) methodology can be applied to both. This week we review the state of the ETF industry and offer some guidelines on how to use them. We stick with equity ETFs this time, rather than the more esoteric exchange traded products (ETPs), but with 2000+ of them available in North America, that should be enough!