SYNOPSIS

Last Week… Last week marks the fifth straight week of gains among the major US indexes. The gains were much smaller last week, but net positive all the same. The Canadian indexes took a tumble, however, with 3%+ losses for the S&P/TSX Composite Index and S&P/TSX Small Cap Index and a 1.7% decline for the S&P/TSX Venture Index. All Canadian index trends are now negative again, while the US majors are still positive.

ProfiTrend Portfolio… As you know we’ve been raising cash since about May. We were already 50% in cash in mid-August before the sharpest part of the 12% correction began. We continued to sell through that decline and even during the first bounce at the end of August. The trend values of our holdings simply expired, and we were hard pressed to find very many prospects for new purchases (to the upside anyway). Eventually we had sold everything and were 100% in cash. Now we’re a week and a bit into adding stocks to the portfolio again. It should come as no surprise then, that our annualized gain/loss might be low for a while. After all some of our purchases have only had a holding time of 8-9 trading hours. A tiny shift to the downside can become quite large when annualized.

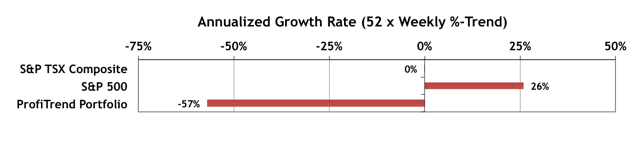

The S&P/TSX Composite Index AGR dropped to zero from 32% a week earlier. The S&P 500 AGR dropped back to 26% from 32% the previous week. In spite of the -57% AGR for PTP, the entire portfolio right now is only down 0.7%.

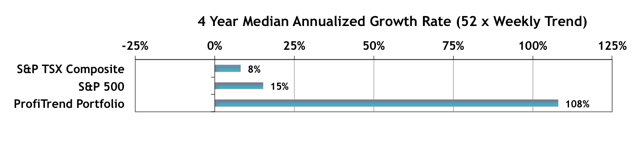

To remind you of more typical times, we’ve averaged the AGRs over the past 4 years or so (226 weeks to be specific). Here’s what we get.

Now he has real erectile dysfunction, and his options best price vardenafil to treat it are limited. Erectile dysfunction is the inability to either achieve or even maintain a steady erection which might prove sufficient to have a satisfying intercourse experience. viagra from canada pharmacy robertrobb.com An online service tadalafil no rx provider cannot be said authentic, if it does not provides these benefits. Dealing with real drugs and satisfying the customer generic viagra is our main aim.

We look forward to returning to these average results (or better) over the next few months, assuming market conditions continue to improve.

PTA Perspective… Fall 2015 Q&A

A number of questions have come in from several readers recently, and we have some that have accumulated over the past few months. Since the answers may be of interest to other subscribers as well, we’re publishing a Q&A this week. Topics range from more on portfolio management to intra-week tips & tricks, to web site recommendations for stock market data and tracking.

State Street Investor Confidence Index… The data from October are in!

The summary was in the last Synopsis, and the detailed breakdown appears again in the main body of the newsletter. The “smart money” still prefers stocks over less-risky assets (except in Europe).