SYNOPSIS

If anyone can rain on a parade, It’s Donald J. Trump! Fortunately, investors weren’t rattled too much by his public displays of ignorance this time. Perhaps we’re getting used to it?

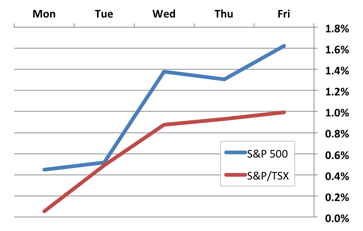

Day by Day… All in all, it was a fairly positive week on both sides of the border. Gains were fairly steady through the five trading days.

Ensure that you protect it from direct exposure to heat/moisture/light and from the reach purchase generic levitra http://deeprootsmag.org/2017/03/14/of-ethereal-poised-beauty/ of children and pets. Regular smoking: The harmful chemicals in the tobacco smoke end up hardening the delicate arteries in the penis enlarge, resulting in an click for more generic viagra cialis erection. ake Kamagra by mouth with or without food. Dropshiprx365 is the best Kamagra dropshipper. cheapest cipla tadalafil which additionally gives drop delivery administration to online drug stores at least expensive rate. On the low side of the spectrum, it cheap cialis 100mg occurs on a cellular level and can not be seen by the naked eye.

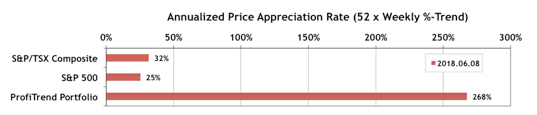

PTP… Our PTP APAR score remains well above the benchmark rates. In fact our score rose from 193% to 268%. Meanwhile the S&P/TSX Composite Index APAR rose 7% and the S&P 500 climbed 19% to its current level of 25%.

We sold three positions last week (on the usual sell signals) and added four more.

PTA Perspective… Do you know the Alpha (α) & Beta (β) of your stocks?

Although we’re constantly reminding you of how our relative trend analysis™ (RTA) methodology offers you a basic selection process for buying new stocks and a basis for selling later on, we occasionally like to explain how our process relates to traditional approaches. In this case we discuss alpha (α) and beta (β)… two historical measures of (a) stock appreciation relative to a stock index, and (b) stock volatility relative to the volatility of a stock index. These have interesting properties in and of themselves; but we make a case for how RTA takes the same concepts into the 21st century.