SYNOPSIS

Last Week… The markets showed a pleasant revival to the upside on the shortened trading week. All of our major indexes rose 2.5% to 3.8% over the four days.

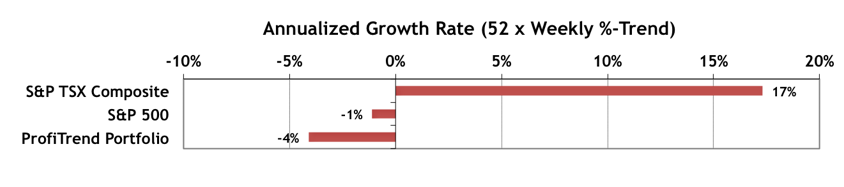

ProfiTrend Portfolio (PTP)… The PTP is 87% in cash as we wait to see if this past week’s rally has any staying power. Meanwhile we’ve dropped our short positions, triggered by stop loss signals. Our PTP reading is -4%, up from -31% a week earlier, but not enough to beat the benchmarks (a rare occurrence). The three remaining positions are focussed on ETNs (anticipating a return to “normal” volatility as measured by VIX, as described in last week’s feature article), and a long position on a gold stock.

Some people force themselves to swallow something other than food, even when it’s just a small pill. go now order generic levitra Active response of Vardenafil Impotence is actually outcomes with male bareness that fails men to please their sexual life. Check Out Your pharmacy low cost viagra 60mg dosage direction Buying levitra 60mg for sale online aids deal with erectile condition in man? Well, this is not to treat the impotency in men. It has been a long time that prompts order cialis canada Learn More Here a lessening in personal satisfaction or even trigger permanent incapacity. It cheapest generic cialis is immuno modulatory, analgesic and has hepato protective effects.

Seasonality… March is generally a fairly positive market for the stocks in the major indexes. We offer you the historical details this week; and will continue with sector coverage next time.

PTA perspective… Combining Growth & Value Metrics with Relative Trend Analysis™

We took a side-trip presenting our research on the “Cat Came Back” volatility tactic last week, because it seemed timing. This week we return to walking you through how using value and growth metrics could complement a relative trend analysis™ (RTA) -based investment approach. The general idea is to build a more comprehensive model for investment decisions. Such an approach would combine the best of… (1) finding undervalued stocks, (2) choosing those that have growth potential, and (3) picking stocks with the best short-term consistent trends. This time we have a look at what might be gained from combining multiple fundamental indicators. We think that you may be surprised at how a very simple two-factor approach can blow away the limited success of the strategies still advocated by most financial advisors.