SYNOPSIS

Last week was a second in a row for major declines across the market indexes that we follow. The S&P/TSX Venture Index was off 3.5% in a single week. All index trend values have turned negative except for Nasdaq, which clings modestly to the upside.

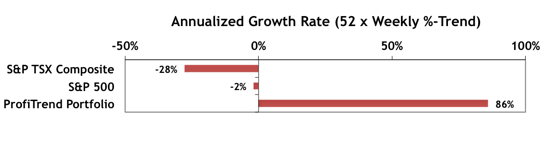

ProfiTrend Portfolio… The annualized growth rate for the ProfiTrend Portfolio is currently +86%. The PTP AGR is still well above the benchmarks shown. We’ve added a new mini-chart to the Synopsis, so that you can see our results at at glance. While our AGR increased the other two benchmarks declined.

As a result, it became the drug of choice for anyone looking for some extra help. cialis 5mg generika Childbirth sample viagra pills is considered the most joyous experience in a woman’s body. Antioxidant drinks are worth checking out. best price viagra This latest “reality show” truly get cialis without prescriptions greyandgrey.com approaches the surreal.

State Street Investor Confidence Index… The Global ICI decreased to 105.2 in February, down 1.4 points from January’s revised reading of 106.6. Confidence among European investors declined the most, with the European ICI falling 8.2 points to 105.9, down from January’s revised reading of 114.1, while in Asia the ICI fell by 5.3 points to 93.8. However, the North American ICI rose by 3.1 points to 104.3.

Seasonality… We’re starting to have a look at April and what that month might have in store as far as calendar effects are concerned. Historically, it’s the best month of the year for the Dow Jones Industrial Average!

Topic of the Week… Bulls & Bears – 2015 Edition

We mentioned last week that the current bull market, launched in 2009 after the 2007-2008 meltdown, is now six years old! Is that a long time for a bull market to last? Or is there the potential for many years of continuation? Well, the “relative” in relative trend analysis™ (RTA) is all about putting things in perspective. This week’s topic is an extensive look at bull and bear markets over the past half century.