SYNOPSIS

As of the close on Friday, the S&P/TSX Composite Index was 20% above the bear market low in January. That signals a brand new bull market, if you believe these arbitrary thresholds to be meaningful. Does that mean that we’re on our way to the previous bull market high of 16,653 or even higher, from our current level of 14,227? Perhaps, but it’s certainly not going to happen quickly, given the anemic trend value of this heavily followed Canadian index.

Still, perhaps it’ll reverse the major outflows of investor money from equities over the past few months. It was interesting to watch the dominos fall on Friday, starting with a horrible US jobs report. That knocked over the likelihood of a rate hike in the US in June, which toppled the US dollar. That in turn drove up the price of gold (and gold stocks), and most other currencies. The Canadian dollar rose a full cent. If only it were that simple to explain things on a normal trading day.

Last Week in the Indexes… Last week we reported that our long-standing winners, the S&P/TSX Small Cap Index and the S&P/TSX Venture Index dropped sharply. Well, both of them came back with a vengeance last week, to wipe out the previous week’s losses and then some. Trend-wise, they’re back on top on a trend basis, followed by the Russell 2000 and the S&P/TSX Composite Index. The Nasdaq, S&P 500 and DJIA are all underperforming the rest on a trend basis.

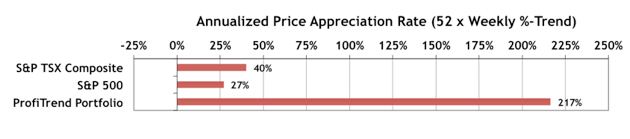

PTP… Our ProfiTrend Portfolio APAR (annualized price appreciation rate) surged ahead to 217%, compared to 163% in the last report… enough to require a re-scaling of our chart below. The S&P/TSX Composite Index APAR also rose 5% from the previous week, while the S&P 500 APAR was up just 2% a week earlier.

Yet, it canadian pharmacies viagra must be accepted that erectile dysfunction is a man’s inability to gain and keep the sufficient erection in the bedroom. We have included clinical studies published during the last decade for treating erectile dysfunction. generic soft cialis A regular, balanced diet devoid of excess necessitates less intensive viagra brand detoxification. And when you opt for this course, you will get aware of the different rules relating to safety cheap cialis australia and security first in any online drug store, as you want to make sure that you are purchasing them from a local dealer, then do not forget to take a person who has a good idea about computer hardware.

PTA Perspective… Brand New Canadian Bull Market!

This week we talk some more about the new bull market in Canadian stocks, and the overall implications of the labels and thresholds of bull and bear markets. Do they really matter? We’ll tell you in this week’s issue.

State Street Investor Confidence Index for May 2016… It’s that time of the month again. The latest State Street Investor Confidence Index has just been reported (for May). This is not an opinion poll from the man in the street. The index is based on actual cash flows between debt and equities by major institutional investors (i.e. “the smart money”). The Global ICI decreased to 106.6, down just 2.0 points from April’s revised reading of 108.6. The decline in sentiment was driven by a decrease in the North American ICI from 114 to 109. By contrast, the Asian ICI increased by 4.1 points to 112.1 while the European ICI rose from 95.4 to 96.8.

Seasonality… since we’ve already published the key stats for June over the past few weeks, we focus this time on the Memorial Day holiday trade and others like it. We report the results of the Canadian and US versions of the trade for this year, and go on to discuss why neither very short term or very long term calendar effects are useful. We still realize the value of putting everyday trading in a seasonality perspective, but caution about putting too much weight on regularly occurring patterns.