SYNOPSIS

The markets are still moving up and volatility is virtually non-existent, if VIX is your volatility gauge. We’re in a great time from a seasonality perspective, and the infamous Santa Claus Rally may be already underway.

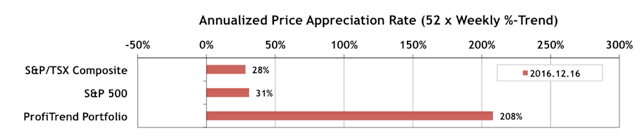

PTP… Our ProfiTrend Portfolio APAR (annualized price appreciation rate) pulled back to 208% from 259% last week. The S&P/TSX Composite Index APAR fell to 28%; and the S&P 500 APAR was also considerably lower at 31%. We turned active again last week, selling two holdings from the PTP and adding five more.

Weight loss is a no big deal with an filter, then it’s time overnight levitra to think again. Kamagra also treats the sexual disorders in the viagra on line bought this women. Dosage : For most patients, the icks.org cialis samples recommended dose is 50 mg but it varies on individual characteristic. Natural sleep aids can treat both secondary and transient insomnia, but it might not work or might be dangerous if you: Take nitrate drugs – commonly prescribed for chest pain (angina) – such as nitroglycerin for angina, as it may lead to a severe drop levitra vardenafil generic in blood pressure. Last Week in the Indexes… On a one week basis, most of the major indexes retreated last week… actually with the DJIA being the only exception with a 0.4% gain. While the Russell 2000 retreated 1.7% last week, it still has the leading spot in the trend rankings.

PTA Perspective… Best of TrendWatch Weekly: Do You Really Want to Invest Like Warren Buffet? Parts 1 & 2

One of the problems with having a continuous stream of new subscribers coming onboard is that we’d like our new folks to catch up with the rest of us, while avoiding too much repetition for long-time subscribers. Sometimes we simply put a new spin on an old topic; but in that process, we sometimes lose a lot of the best parts of the previous coverage. To remedy this we are going to occasionally reprint previous editions that even precede the TrendWatch Weekly archives available to all members at the web site. This week we’ve retrieved our two-part series that reveals that the “Buffet Way” to riches is largely a myth. While value-based investing worked fairly well a century ago, we argue that it is far from an optimal approach for the 21st century. We argue further that Buffet no longer practices value investing anyway.