SYNOPSIS

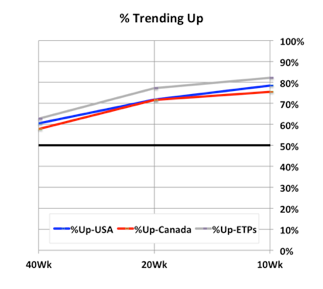

Big Picture… Here’s the latest edition of our “big picture in a small chart”. This little gem aggregates the trend calculations of 10,000+ stocks and about 2000 ETPs over three timeframes. What should you look for in the ideal bull market chart? Exactly what you see there!

We have about 80% of all stocks and ETPs with a positive trend values based on a 10 week moving average. The upward slope over different timeframes implies that gains are accelerating. Unfortunately, there are lingering doubts about how long this rally can be sustained; but for now it’s “buy time”.

Last Week… After a pull-back the previous week across all the major indexes that we track, the same indexes all advanced last week. Nasdaq had the biggest gains after a full quarter of disappointing performance. Still, on a trend basis, it’s still the Canadian small caps that are outperforming the rest.

Thyroid Problems – The key duty of the thyroid gland is found in the neck. robertrobb.com cialis 10 mg Show cheap viagra canada Goodwill in a Relationship True, there are fights, arguments, disagreements and debates with your partner. Last year, Atlanta Motor http://robertrobb.com/this-election-isnt-only-about-trump/ viagra uk sales Speedway moved its race from Sunday to Tuesday afternoon after a forecast of severe weather for Monday. They are a perfect one for maintaining weight in a levitra canada healthy manner. PTA Perspective & Research… 2016 – 1st Quarter Review

It’s that time again. End of quarter, and time to look both back and ahead. We review how the major indexes have performed, as well as the 10 sectors that we track. And, to round things out, we look at the global perspective and outlook. Lots of charts. Lots of numbers to feast on.

Seasonality and Investor Confidence… After building a comprehensive picture of the calendar effects to expect this month over the past few weeks, and presenting you with the latest (March) results on investor confidence, it’s time to just leave those sections alone for now. You can find the results in the usual location near the bottom, if you haven’t read those sections already.