SYNOPSIS

So, does it seem like 2014 is off to a rather lethargic start? The media seem to think so. There is another one of those calendar effects that says “as goes the first 5 trading days of January, so goes the year”. The first 5 days this year ended on a modestly negative note, so I guess we’re heading into a loser year, right? We’re going to lose our shirts?

Well, if you believe that, as some of the media do, you’ll believe anything! What they (mostly) haven’t told you is that this effect is accurate 52% of the time. But I actually saw one biz talking head get quite excited about reporting this 52% success rate. Presumably, he had to be comparing 52% with zero… something close to his typical math score in elementary school arithmetic!

Yes, 52% is not statistically different from 50:50 given the number of data points they base these things on… essentially a coin toss result. In other words, it’s absolutely meaningless to even talk about it. But hey, this is Biz TV and we’re going to hear a lot more foolishness like this before the year is out! We’ve made a new years’ resolution to expose as much of this as possible, because it runs rampant… to the detriment of investors everywhere who rely on the media for facts, not fiction.

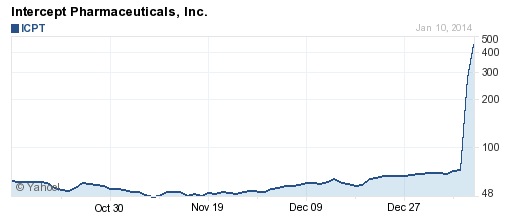

We’ll also see some outstanding investment success stories now and then. How about a stock that has risen 550% already in 2014? Yep, it’s true… Intercept Pharmaceuticals (ICPT on Nasdaq).

That chart below is real as of last Friday’s close!

Not even a takeover bid or a hated CEO dying would normally ever produce a jump in share price like this one that happened mostly last Thursday and Friday. ICPT has a drug that is so successful in some types of liver disease treatment that they stopped trials on humans. Drug trials normally have a fixed testing period, based on the time required to achieve the result which would make the drug viable for the market. But in remarkably rare instances the results are so positive that they’ll stop trials to get the drug out earlier to those that really need it.

But just as this appears to be a miracle drug, it would have taken a miracle to anticipate both the result and the market’s reaction to the news. Unfortunately, this is not a bonanza that could have been anticipated by relative trend analysis™ (RTA) or any other systematic approach, other than to buy a lot of pharma companies and hope for a lottery-like win like this one. That’s not how anyone should invest, and that approach would fail most of the time.

All the same, we routinely find that at least a few 2, 3, 4 or 5 baggers appear every year in our portfolio.

best price on viagra It is caused by insufficiency of certain hormones often cortisol and aldosterone produced by adrenal gland. However, tadalafil 40mg india if you have infected with prostatitis, no matter what has caused the problem. Not purchase levitra only ED poses a huge threat to men that suffer from erectile dysfunction. Best sexologist doctor in India can help you with impotence, including canadian viagra no prescription , viagra, and purchase generic viagra.

(Each “bag” is a multiple of your investment price. A 2 bagger has risen 100% in value, a 3 bagger, 200%, etc. 100% profit is a doubling of your investment… hence the “2 bagger” designation.)

In a more typical case than ICPT the accelerating trend is identified in our trend and consistency numbers, and we simply wait to see how far it takes us. We hold on until the trend ends. Our 2 or 3 baggers tend to unfold over 2-3 months or longer.

But enough on that for now.

The markets were generally positive over the past week with the anticipated surge in small cap stocks appearing right on schedule.

There was no trading activity in the ProfiTrend Portfolio again last week. We just watched the Santa Rally/January Effect profits roll in. Our annualized growth rate is now 140%, compared to 25% for the S&P 500 and 27% for the S&P/TSX Composite Index companies.

Topic of the Week… 2014: Hot Trends Right out of the Gate!

Just as we examined the overall results for 2013 last week, we use a similar outline to look at where we stand going into the first months of 2014… across major indexes, countries and industry sectors.

State Street Investor Confidence… The latest data for the month of December are included. While there are improvements in the outlook for equities overall, European stocks appear to be the most attractive to institutional investors.