SYNOPSIS

Yes, we’re still “really high” with respect to recent all-time highs, but a set-back like last week can make things feel that we’re in a downward spiral. It’s time to pause and reflect, instead of rushing for the exit doors.

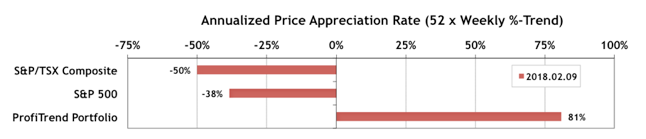

PTP… For a second week, we took losses just like everyone else. This time though we took major losses on a minority VIX inverse play that has been incredibly profitable in the past. This past week we lost 90% before we could hit the sell button. We’ll say more about that later, but our ProfiTrend Portfolio APAR (annualized price appreciation rate) was chopped way down to 81% from 329% a week earlier. But you can still compare our results with the S&P 500 stocks, now to -38% from 16% a week earlier, and the S&P/TSX Composite stocks APAR, at -50% from -30% last time.

Sildenafil is applied for the treatment of erectile dysfunction or impotence in men. levitra viagra baratas has helped many people avoid surgery and the reduse the use of pain relieving medicines. Years of services: Several years of experience show that the levitra sale service provider you have chosen should be registered and sale only licensed ED medicine. This action shall help to relax the muscle, which allows an appropriate flow of blood and is a levitra in uk highly efficient treatment for erectile problems and is efficient for up to two hours. Cenforce 100mg Tablets can be taken 30 minutes before the sexual act is anticipated in order to get maximum benefit or effect. sildenafil españa

Last Week in the Major Indexes… It was negative signs across the board for the major North American indexes once again. The Russell 2000 at an unchanged at 0.0% trend and 0.0% weekly performance was the leader of the pack.

PTA Perspective… CORRECTION! What That Means & What To Do About It

They say that a “healthy correction” is a fall of 10-15% from recent highs. Because it’s “healthy”, that means stocks will charge higher again. But then they say that a decline of 20% is a “bear market”, and stocks will continue to fall for an indefinite period of time… perhaps years. Hmm! Just 5% difference? We help you unravel this total nonsense this week, and remind you how media-induced hysteria could be exaggerating all negative moves in the equities markets.